|

|

|

March 12th, 2021 at 07:46 pm

I thought I would be out of debt approximately 1 month from now. However, I don't think it is going to work out quite that way.

I went to bed Monday evening and woke up about 1am Tuesday morning, having trouble getting a breath. I got out of bed, used my inhaler, sat in a chair so I was upright, and waited. Around 4am, I was still having trouble, so decided I would go to urgent care. They ended up admitting me to the hospital; I was discharged yesterday.

It turns out that my blood pressure had gone really high, causing problems for my heart and my lungs had filled with fluid. I am seeing a cardiologist and I am now on quite a mix of medications which are keeping my blood pressure where it should be. I do have a good insurance plan, so while I am expecting some medical bills to pay, I am not expecting that they will be catastrophically large. Still, I will make no more additional principal payments until the medical bills have all been received and paid.

I had a Dr. appointment this morning and am home taking it easy now. I will go back to work Monday.

I have not yet heard a thing from the local water district.

Posted in

Uncategorized

|

3 Comments »

March 6th, 2021 at 03:42 pm

I feel that my interview yesterday went very, very well. There were 3 people interviewing me via Zoom; the same two people who interviewed me last time and a third person. And I learned that they currently have 2 open positions. It is a small office, so 2 open positions must be quite a hardship on the others. They intend to make a decision next week. So, we will see. If they do not offer me a position now, then they just aren't interested in hiring me. I do not know how many qualified candidates they interviewed.

Right now, I earn $25.79 per hour, and I am topped out. I can't earn more unless I promote to a higher position. The water district has 3 classifications of Administrative Aide (I, II, and III), and each has 7 pay steps. There is some overlap between them (bottom step Administrative Aide II is less than top step Administrative Aide I), and they do have some discretion to start you or promote you as they see fit. Still, the position is clearly for Administrative Aide I. Bottom step is $17.50 per hour. So you can see, that is a significant cut from $25.79 per hour. I may not have to start at bottom step, but then again, I may have to do just that.

Last summer when I interviewed, I still owed 27k on the 5th wheel. Taking a pay cut to $17.50 would have been the end of accelerated payments, and I felt very hesitant to pursue such a plan. I didn't want to spend years making only minimum payments, I wanted the debt gone. At this point, however, it almost is gone, so isn't as much of a concern.

There are very few jobs up here period. Most of the jobs which are here are very low paid. It is pretty amazing to me that a CalPers covered clerical job is here at all, much less in an office 10 minutes from home. I would be extremely grateful to land this job, $17.50 or not.

Posted in

Uncategorized

|

4 Comments »

March 4th, 2021 at 02:20 am

Remember last summer when I interviewed for a position at the local water district, with the office right in my tiny town? I'm not sure if I ever mentioned it, but they did eventually send me a letter just saying that someone else had been a better fit but that they encouraged me to apply again in the future. Well, last week they had another opening and I did just that. I have a Zoom interview this Friday. So, we will see.

Last time, I wasn't positive that I wanted it. This time, I am sure. I hope that will come across in the interview. It would be a pay cut, but with my debt nearly gone, it's not so much of an issue. I would continue to earn service credits towards my pension, I would have health insurance, and I would be a 10 minute drive from home. That is sounding really good to me. Wish me luck.

Posted in

Uncategorized

|

9 Comments »

March 3rd, 2021 at 02:18 pm

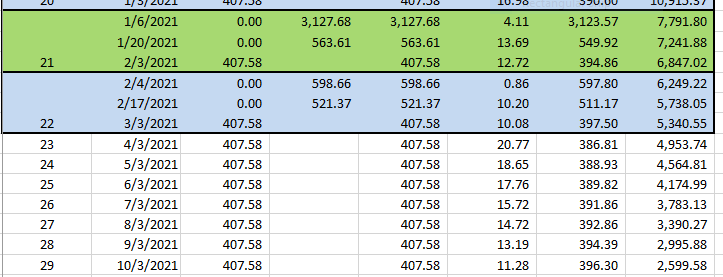

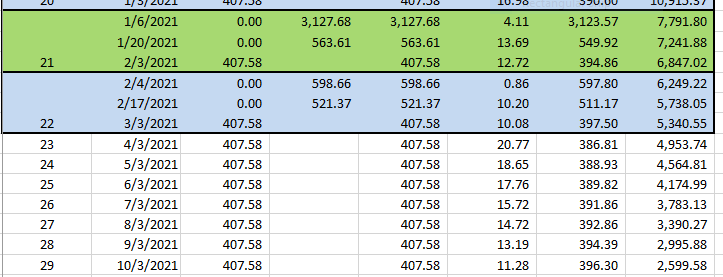

or number 17 since the refinance.

The regular monthly payment posts today, 3/3/21, bringing the principal balance down to $5,340.55. Since the previous regularly scheduled payment, I managed to pay an extra $1,120.03, all from regular monthly income. The last payment date has moved up to 5/3/22; that is 1 year and 2 months to go if going forward I pay only the regular monthly payments.

At this point, I have enough in checking and savings to pay the loan in full, with about 1k to spare. I'm not going to do it just yet, but this loan isn't going to be around much longer.

Posted in

5th Wheel Loan

|

1 Comments »

February 25th, 2021 at 02:40 pm

Look at what I can do this morning, after MONTHS of not being able to:

I don't know if it is because someone finally addressed whatever was wrong or if something reset itself or what, but I am so delighted! Who-hoo!

Posted in

5th Wheel Loan

|

3 Comments »

February 5th, 2021 at 03:02 am

I was cleaning out my email inbox today and I came across an email which caught my interest. It was from CitiBank and it was about a promotional sign-up bonus to open a checking/savings account package. I have never done one of these offers as they are typically not enough to tempt me. However, this one is.

If you bring 200k or more to CitiBank, the sign-up bonus is $1,500. It doesn't have to be 200k in cash, just 200k in total. Investment accounts, such as IRAs, count towards that 200k. Included in the deal is free etf trades for brokerage accounts. This works fine for me as I hold nothing but etfs in my traditional IRA anyway.

If you bring 50k or more, the sign-up bonus is $700.

If you are interested in this deal for yourself, you can read the details here: Citibank Savings Bonus: Up To $1,500 | Bankrate

There are a few drawbacks, such as the $150 fee I will pay to transfer my IRA from Wells Fargo, the hassle of changing direct deposit, automatic transfers, etc. And, there is no Citibank branch conveniently located to me. There is a Citibank ATM not too far from my office, but that's it. (If I wanted a cashier's check or something else you can only do in a branch, I'd have to drive about 1.5 hours from home, each way.) However, the account does include non-Citibank ATM fee reimbursement, so access to cash is not an issue.

I haven't made up my mind yet, but I am leaning towards it.

Posted in

Uncategorized

|

0 Comments »

February 3rd, 2021 at 01:58 pm

or number 16 since the refinance.

The regular monthly payment posts today, 2/3/21, bringing the principal balance down to $6,847.02. Since the previous regularly scheduled payment, I managed to pay an extra $3,691.29. About $1,900 of that came from sinking funds, $600 from my stimulus payment, and the rest from my paychecks. The last payment date has moved up to 8/3/22; that is 1 years and 6 months to go if from this point forward I pay only the regular monthly payments.

I have given up on the pictures. I have tried using other browsers and using "incognito" web pages as the tech suggested. Still nothing happens. I don't know that I will ever be able to do my budget review entries. Frankly, it makes me lose a great deal of interest in keeping this blog; the entire point is to use it to track my finances and I can't do it the way I would like any longer.

Posted in

5th Wheel Loan

|

4 Comments »

January 3rd, 2021 at 03:24 pm

or number 15 since the refinance.

The regular monthly payment posts today, 1/3/21, bringing the principal balance down to $10,915.37. Since the previous regularly scheduled payment, I managed to pay an extra $1,363.03. The last payment date has moved up to 6/3/23; that is 2 years and 5 months to go if from this point forward I pay only the regular monthly payments.

Still no ability to upload pictures, so my "5th Wheel Amortization" page can still not be updated.

Posted in

5th Wheel Loan

|

2 Comments »

December 4th, 2020 at 03:35 am

or number 14 since the refinance.

Well, I decided to pull a chunk out of savings and pay it on the loan. I am just SO impatient to get it paid in full.

The regular monthly payment posted on 12/3/20, bringing the principal balance down to $12,640.14. The last payment date has moved up to 10/3/23; that is 2 years and 10 months to go if from this point forward I pay only the regular monthly payments. If I were able to upload pictures, I would update my "5th Wheel Amortization" page. But, our ability to upload pictures seems to be gone, so I won't.

Posted in

5th Wheel Loan

|

1 Comments »

December 1st, 2020 at 04:04 am

My little nest egg has broken 400k.

Looking back, it broke 200k on 5/22/14, just over 6.5 years ago.

Posted in

Uncategorized

|

3 Comments »

September 23rd, 2020 at 03:02 am

The past two weeks have been a bit topsy-turvy for us. First with the planned power outage, then with the Fork fire starting during the outage, about 26 miles from our home. The mandatory evacuation line was about a mile past our place, but we chose to voluntarily evacuate.

The evacuation order has since been lifted and the fire is fairly well under control. It is expected to be out soon. We are safe and fine.

We had some extra expenses during the evacuation which SB and I split. I am behind on my bookkeeping, but will catch up eventually.

We are crazy busy at work. My department has undertaken a BIG project on top of our regular work, and just as we were getting started one person left. (She got a big promotion and is now working in another department.) When I get home at night, I just put my feet up and relax. Catching up on my bookkeeping just hasn't been my priority.

Posted in

Uncategorized

|

4 Comments »

August 15th, 2020 at 05:11 pm

I have never heard back from the local water district. I accept that if it were the right job for me, it would have just fallen into place.

Unfortunately, my laptop got dropped and the screen got a huge crack.  I thought about looking into replacing the screen (how much it would cost, etc.), but then decided no, I don't want to do that. I allow Google to save all of my passwords, so dropping my laptop off at a repair place means I am vulnerable to complete strangers logging in to my bank accounts, etc. I ended up at Best Buy and bought a new one; my EGadgets sinking fund will cover most of the cost. I thought about looking into replacing the screen (how much it would cost, etc.), but then decided no, I don't want to do that. I allow Google to save all of my passwords, so dropping my laptop off at a repair place means I am vulnerable to complete strangers logging in to my bank accounts, etc. I ended up at Best Buy and bought a new one; my EGadgets sinking fund will cover most of the cost.

I am done paying for my dental work! My partial is almost complete, I may be taking it with me at my next fitting (or it may need to go back for another adjustment). It is a long process, getting a denture. I transferred all but $1 from my dental sinking fund to checking. I had saved more than I needed, the excess will of course go to debt. I renamed that last dollar "Car Replacement Fund".

And lastly, I bought another planner. It is a simple, inexpensive one from Mead, and so far it is working out perfectly for me.

This coming week, I expect to make an extra principal payment of approximately $1,100. I am really looking forward to it.

Posted in

Spending

|

2 Comments »

August 8th, 2020 at 02:18 pm

or number 10 since the refinance.

The regular monthly payment posted on 8/3/20, bringing the principal balance down to $27,142.63.

Since the previous regularly scheduled payment, I managed to pay an extra $783.04.

The last payment date has moved up to 1/3/27; that is 6 years and 5 months to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

1 Comments »

August 7th, 2020 at 03:13 am

Wages -So, my net pay has dropped by approximate $12.60 per paycheck due to my pension contribution rising a bit.

Transfer In - I estimated I would spend $300 on my trip with Mom to Manhattan, NV but transferred $259.98 because I thought that was what I had spent. I actually miscalculated (more on that further down).

Also, my son-in-law's birthday is in July. I always send my kids and their spouses $50 for their birthdays.

Other - I sold an unneeded item for $100. Yay!

I spent less cash than budgeted. Always nice.

My phone bill was a bit higher than expected, but otherwise no surprises here.

Two sinking fund deposits of $230 each happened in July.

Extra principal - I sent $783.04 to extra principal, less than planned.

Mom-Amazon - Items Mom wanted which I ordered for her. She will reimburse me (and has by now, just not during July).

Broad loan - A short-term loan to a friend. We call each other "Broad".

Mom-trip - Mom's share of expenses for our road trip. She will reimburse me (and has by now, just not during July).

Sheets - A new set of sheets for our bed.

Bra - A new bra. I did not pull money from my clothing sinking fund to reimburse myself, but I probably should have.

Meal-trip - A meal which I inadvertently did not add to the cost of the Manhattan trip. I did not pull money from my travel/vacation fund to reimburse myself, but I probably should have.

July ended with $1,083.57 in checking.

I wanted to end the month with $1,055.07 in checking. Apparently, I subtracted my life insurance premium twice when calculating how much extra principal I could send to my 5th wheel loan. I should have sent $28.50 more.

Lots of little math errors this month, I don't know what to tell you.

Posted in

Budgeting

|

1 Comments »

August 4th, 2020 at 03:20 am

On Thursday, I interviewed via Zoom for the job at the local water district. It went pretty well, but of course they have other candidates. They said they will be making a decision "early next week", which is this week. So, we will see what happens. I keep alternating between being excited for a shorter drive and thinking no, making less money would be a mistake.

On Saturday, my mom drove up for the day and brought along a friend of mine who lives in her town. (This is the same friend who occasionally comes to my mom's house when we are playing cards.) They got here early and we played cards all morning and into early afternoon. We have a canopy set up outside, with a mister, and you can hear the gurgling of the creek. It is a great place to hang out. SB grilled some burgers for lunch. They left around 4pm; the day went by so fast. It was so nice to have someone come to see us! It doesn't happen often.

Posted in

Uncategorized

|

2 Comments »

July 11th, 2020 at 02:27 am

Well, I applied for a job this week. It pays less than the job I have now. Why would I do this, one might wonder. The job is for the local water district, and their office is 10 minutes from my home. Right now, I spend a minimum of 45 minutes commuting each way. That's in good weather and with no road construction projects. Currently, I am taking a longer route due to 3 (!) construction projects on my usual route. It is just under an hour each way.

I'm not entirely certain if I hope that I get this job or hope that I don't. I really have some great co-workers and I don't have a desire to work as many hours while making less money. But, getting an extra 1.5 hours of free time daily is VERY appealing. Also, I would save a bit on gas and car maintenance.

The opening came up, I happened to see it, and just felt I had to give it a try. We'll see.

Posted in

Uncategorized

|

11 Comments »

July 10th, 2020 at 01:23 am

or number 9 since the refinance.

The regular monthly payment posted on 7/3/20, bringing the principal balance down to $28,225.67.

Since the previous regularly scheduled payment, I managed to pay an extra $745.61.

The last payment date has moved up to 4/3/27; that is 6 years and 9 months to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

2 Comments »

July 9th, 2020 at 02:52 am

Posted in

Budgeting

|

0 Comments »

July 5th, 2020 at 06:08 pm

I took a vacation day on Thursday, and Mom and I went on a short road trip to Manhattan, NV. My family lived there briefly in the winter of 1969-1970 and Mom has been wanting to reminisce.

I left home early Thursday morning (with Bella), headed to Mom's, then we were on to Tonopah, NV. We stayed at a wonderful old hotel called the Mizpah Hotel. I highly recommend it, should you ever find yourself in the area. Our junior suite was spacious, luxurious, full of beautiful antiques, and cost $129 per night. We could not go into the restaurant because I had Bella, but they have a wonderful lounge in the lobby where pets are welcome, and you can order and be served from the menu. The menu was small but the food was excellent; Mom said they serve the best fish & chips she has ever had. I ordered a burger and garlic fries, and they were both delicious.

Friday morning we were on to Manhattan. The population was 22 (including the 4 of us) when we lived there, but has since ballooned to 124. The retired postmistress still lived in town, and my mom was able to visit with her for awhile. She wasn't much younger than my mom and remembered people Mom had known. That was fun for her. Next, we headed to Fallon where the daughter of a long-time friend (now deceased) of my mother lives. Mom hadn't seen this daughter in about 30 years. We stayed in her home for about 3 hours and had a nice, fun visit. Next, we headed to Fernley, NV. We had learned a few days before that coincidentally, my brother and his wife were planning to be there for a few days! We met for dinner and had a nice time.

Saturday morning we were on the road early. I had planned to take Mom home from there before heading home myself. However, Bella seemed to be tiring of the trip so I changed my route and took her home first (leaving her with SB), making a round trip to Mom's to take her home. I got home about 6pm, tired from all of that driving.

Today I am just kind of taking it easy. I may or may not get my June budget report and 5th wheel payment #14 posted today.

Posted in

Travel

|

2 Comments »

June 5th, 2020 at 01:15 am

or #8 since the refi.

Well, another regularly scheduled payment has been made. The new principal balance is $29,270.38. So glad to be under 30k!

Since the previous regularly scheduled payment, I managed to pay an extra $907.46.

The last payment date has moved up to 7/3/27; that is 7 years and 1 month to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

1 Comments »

June 2nd, 2020 at 02:06 am

May was a 3 paycheck month for me so I had a little extra income to work with. I planned that I would transfer in $50 from a sinking fund for a birthday gift. "Buffer" is the starting amount in checking and not much "other" income was expected.

3 paychecks means 3 cash withdrawals during the month. We have been buying groceries mainly in our little town, rather than driving down to a larger town with lower prices but more shoppers. SB and I agreed I would kick in an extra $100 for groceries. However, with gas prices low and not going anyplace but to work and back, I have been consistently spending less cash than budgeted.

I did finally get around to switching back to Ting. So far, all is going fine. I am hoping to enjoy a lower monthly phone expense.

Sinking fund deposits went exactly as planned. Spending from sinking funds included my great-grandniece's birthday gift (just a check for her savings account) and a vet bill for Bella. She had another ear infection.  It's a good thing I started tucking a little bit away for her expenses, and now that fund is all but wiped out. It's a good thing I started tucking a little bit away for her expenses, and now that fund is all but wiped out.

I had planned to send $2,392.57 of extra principal to the 5th wheel loan, and am pleased to report I managed to send $2,564.54.

I have a niece who is very active in cat rescue and she reported on Facebook that she could really use some food donations. So, I purchased $26.13 worth of cat food for her use. (She has a wish list on Amazon, which does make the process simple.)

The month ended with $1,637.60 in checking.

I had wanted to end the month with $1,637.58 in checking. That's my 1k buffer, a $230 sinking funds transfer scheduled for 6/2/20, and my monthly 5th wheel payment of $407.58 which happens automatically on 6/3/20.

All in all, a good month financially.

Posted in

Budgeting

|

6 Comments »

May 3rd, 2020 at 11:55 pm

or #7 since the refi.

I haven't done one of these updates in 3 months, and some solid progress has been made in the interim. During the past 3 months, I managed to pay an extra $3,559.95.

The new principal balance is $30,468.52. I have now passed the 1/3 repaid point. Super glad about that!

The last payment date has moved up to 10/3/27; that is 7 years and 5 months to go, assuming no further extra principal payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

0 Comments »

May 3rd, 2020 at 04:36 pm

Other income included:

$2,045.55 - refund from Citibank from our cancelled Princess cruise. I owed about half of it to my mom. (We do a full reconciliation after a trip. Sometimes I pay initially for her share of things, sometimes she pays for mine. Also, the refund was less than the credits from Princess because I had other charges on the card which do not come out of vacation money.)

$1,200.00 - stimulus

$396.28 - redeemed credit card rewards

$200.00 - short-term loan repayment

$0.02 - checking account interest

You sure don't spend much cash when you are self-isolating.

Mostly as expected. I have not yet looked into switching my own line back to Ting.

Sinking funds were deposited as planned. My total vacation costs ended up being less than I had withdrawn, so the excess of $409.55 went back to travel/vacation. There are no vacations on my horizon at the moment.

The only withdrawal in April was $481 for 5th wheel registration.

Other expenditures for the month. Here is the repayment to my mom as well as a payment to Capital One Savor card for vacation expenses. The rewards have already been redeemed, so I will cancel this card now. (I opened it for the $300 bonus and I am not interested in paying the $95 annual fee for this card.)

The $2 bank fee is for a non-Wells Fargo ATM. I normally get reimbursed for these, but my qualifying balance slipped below 250k so I did not. It was worth it, though. I like to use the ATM at the only bank in my tiny town. Especially right now, since we are all trying to avoid encountering other people.

Ending balance in checking is $2,428.82.

My target ending balance for checking is $1,407.58. The excess will go to extra principal on the 5th wheel loan in May. (In fact, it already has).

Posted in

Budgeting

|

1 Comments »

March 27th, 2020 at 01:43 am

Well, that was an eventful vacation. As you know, we were booked on the Caribbean Princess. We flew to Fort Lauderdale, Florida on Tuesday, 3/10/20. My daughter drove from Illinois and met us at our motel. We were having dinner in the attached restaurant about 9pm when I received emails from Princess that our cruise had been cancelled. The email also said we would receive a 100% refund plus a 100% credit towards a future Princess voyage. (I have already received credits to my credit card). Following a short discussion, I called VacationsToGo and was able to book a 7 day cruise on the Holland America Veendam leaving Fort Lauderdale the next day. It had a different itinerary of course. The ship is a much smaller ship than we are used to, but it was perfectly nice. Because of all of the cancellations (I assume), the fare was surprisingly low.

Before boarding the Veendam, every passenger had their temperature taken and anyone out of the normal range was not allowed to board.

We visited Half Moon Cay in the Bahamas, Ocho Rios in Jamaica, and Cozumel in Mexico. We were scheduled to visit Grand Cayman but were not allowed to stop there. We returned to Fort Lauderdale on Wednesday 3/18/20. Since we had originally booked a 10 day cruise, we had a few extra days to play with.

We decided to return to the same motel (it was affordable, surprisingly nice, with a great shuttle service). On Thursday, we visited the Everglades and took a fan boat into the swamp to view wildlife. For me, that was the highlight of the trip. I called to see if we could change our flights from Saturday 3/21/20 to Friday 3/20/20, and if so what it would cost. Well, they switched our flights with no fee whatsoever plus a $52 voucher per person.

As always, it was no fun to say good-bye to my daughter after having enjoyed her company non-stop for 10 days. We had a wonderful time together, though.

As it happened, we landed in Saramento a few hours before the shelter-in-place order in our state went into effect.

So what is going on with my job? It turns out that my department has been deemed essential so we are working. Some people are choosing to work from home which isn't really a good option for me as our internet is unreliable (to put it mildly). I have chosen to self-isolate and am taking sick time. (My supervisor is fully aware that I am not actually sick, nor is anyone in my family). We are having a lot of rain, hail, and snow, so I am not even going outside much.

Posted in

Travel

|

4 Comments »

March 7th, 2020 at 05:16 pm

On Thursday my new dentist confirmed that a partial would work for me. So, that is the route I am going. I realize it will be an adjustment to get used to wearing it, but lots of people do it and I can do it too. The cost for a partial is about $1600 before insurance pays their portion. Currently, there is a balance of $2232.79 in my dental sinking fund. I will wait until all is done and paid for, then throw the remaining balance at debt.

Yesterday was payday and I was able to send $248.29 off to the 5th wheel loan, bringing the balance down to $34,351.95. It feels great to make a little progress.

We fly to Florida Tuesday morning and sail on Wednesday. We are not canceling our trip due to the current panic, which I personally feel is blown way out of proportion.

The cruise line sent an email stating that we can cancel for a 100% credit towards another sailing if we wish. We don't. Also, they are crediting us $200 per cabin as a thank you for not canceling.

Our ship is the Caribbean Princess. So I guess if you hear that the Caribbean Princess has been detained someplace, you'll know what is going on with me.

Posted in

Travel,

5th Wheel Loan

|

7 Comments »

March 1st, 2020 at 08:04 pm

Wages - as expected.

Transfer in - money in from sinking funds (see below).

Buffer - beginning checking account balance.

Other - income tax refunds, a cash birthday gift, CC rewards, and checking account interest.

Managed to spend a bit less than budgeted. It's a wash, though. (See Wal-mart item under "other").

Now that Ting is offering service on Verizon's network, I am looking forward to shaving a bit of money from my phone bill. I will be looking into that this month.

Deposits went mostly as expected. I think I have sufficient money now for my dental expense. I have an appointment this Thursday and will know more then.

Money that went out:

Car Ins & Reg - CR-V registration

Car R & M - a minor tune-up

Clothing - replaced my jacket which got too close to a space heater and melted a bit. Also, a new bathing suit, cover up, and casual dress for the cruise. All items purchased on Amazon.

travel/vacation - paid for cruise fare for self and daughter, air fare for self. Remaining balance plus $300 Capital One Savor sign-up bonus will need to cover gratuity, excursions, and 1 night lodging in a motel. It should be enough.

These items were mostly paid with sinking funds, so discussed above. Those which weren't:

Bella vet - transferring money from the appropriate sinking fund would have wiped it out. Instead, I just let it go.

electric toothbrush - recommended by dental hygienist.

Wal-Mart - a mixed bag of household and personal items. Normally I would pay cash for these items, but I just used a CC as it was simpler at the time.

And that is it. Not a bad month all in all, and I am hopeful that I am now ready to apply extra funds to the 5th wheel loan.

Posted in

Budgeting

|

2 Comments »

February 17th, 2020 at 07:59 pm

This entry is very overdue. Loan payment #9, or #4 since the refinance, has posted. The new principal balance is $34,868.16.

Since the previous regularly scheduled payment, I managed to pay an extra $1,668.98.

The last payment date has moved up to 10/3/28; that is 8 years and 8 months to go.

When I went for my dental cleaning, the hygienist asked if I had considered a partial. I am going to discuss it with the dentist when I go for my next filling.

My birth mom has been here visiting for the past 2 weeks, which included my birthday. She has recently given up her apartment and is, for now, completely nomadic. I am so jealous! I hope that she enjoys this next chapter of her life. She plans to be back this way in a few months, so we will see her again then.

Posted in

5th Wheel Loan

|

2 Comments »

February 1st, 2020 at 08:22 pm

Posted in

Budgeting

|

0 Comments »

January 26th, 2020 at 01:25 am

So I did end up cancelling the appointment to do the prep work for the implants. They re-scheduled for the crowns, but I have decided I am going to cancel that too. I am just not happy about the abrupt change in treatment plans. The former dentist, whom I really liked, said that I needed more fillings and a deep cleaning (below the gum lines). The new dentist says I don't need any of that, but do need crowns. The former dentist said nothing about needing crowns.

Maybe I am completely wrong, but I kind of get the vibe that I am more a source of revenue than a patient. I am going to get another opinion and most likely switch dentists.

Yesterday was payday and I sent $374.25 off to my dental sinking fund. I wish that I were sending it off towards the 5th wheel loan instead.

I filed my tax returns this morning using Credit Karma's free service. I am expecting a total of $1,109 between federal and state. Those dollars will go into the dental fund too.

We have booked our Panama Canal cruise ("we" being my mom, my nephew, my daughter and I). Sailing on the Caribbean Princess, with stops in Jamaica, Grand Cayman, Colombia, Costa Rica, and Panama. Should be a great deal of fun.

Posted in

Uncategorized

|

5 Comments »

January 14th, 2020 at 02:11 pm

Made another principal payment yesterday in the amount of $1,668.98. Balance is down to $35,183.28.

I also had a dental visit yesterday. The dentist I had been seeing left the practice some months ago. The new dentist has a new treatment plan. This new plan includes two crowns and prep to do implants, which I will need to have done elsewhere. My share of cost is $5,400 plus whatever the periodontist charges for the implants. So, we are talking about a large dental bill.

Background: I have ruined my teeth with vitamin C drops and cough drops by having one in my mouth constantly. I have used this method to cope with my constant persistent cough. (I switched to only sugarless cough drops with no citric acid, but the damage was already done.) In the past year, I have had 3 extractions and 8 fillings. I still need more fillings and a deep cleaning, below the gum line. Previous dentist recommended doing a little at a time, which I had been doing.

The dentist wants to begin right away. I made an appointment 2 weeks out, but may cancel. I am not certain I wish to proceed. I think I may try to find where the previous dentist went. SB said I should also consider Mexico.

Also, the extractions were all in the back of my mouth. Two on the lower left and one on the lower right. So I don't APPEAR to be missing any teeth.

I think I am going to stop my extra principal payments for now and save the money instead, until I have a plan of action for my teeth.

Posted in

5th Wheel Loan

|

6 Comments »

|

I thought about looking into replacing the screen (how much it would cost, etc.), but then decided no, I don't want to do that. I allow Google to save all of my passwords, so dropping my laptop off at a repair place means I am vulnerable to complete strangers logging in to my bank accounts, etc. I ended up at Best Buy and bought a new one; my EGadgets sinking fund will cover most of the cost.

I thought about looking into replacing the screen (how much it would cost, etc.), but then decided no, I don't want to do that. I allow Google to save all of my passwords, so dropping my laptop off at a repair place means I am vulnerable to complete strangers logging in to my bank accounts, etc. I ended up at Best Buy and bought a new one; my EGadgets sinking fund will cover most of the cost.