Budget By Paycheck 4/28/23

April 29th, 2023 at 02:52 pm

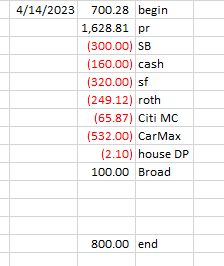

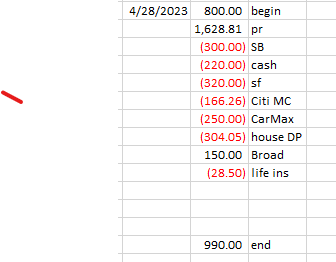

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - My budgeted amount is $260, but I only needed $220. I forgot to adjust before I made my House DP transfer, so I ended up with an extra $40 in checking. I just left it there, because I will have a big expense to pay beginning with the next paycheck. More on that below.

sf - automatic sinking funds transfer which will happen on 5/2/23.

Citi MC - the balance on my Citi MC. It included $149.35 for a meal out, and $16.91 for Sirius XM. The meal out was dinner and drinks for 3. I have a couple of girlfriends from work, we all now work in different departments in different buildings. We meet up every month or two at a particular restaurant. We take turns paying, and it was my turn. The restaurant has gotten a bit pricey, as you can see. The Sirius XM is a new expense. When I bought the Tucson, 3 months were included free. Then I received an email offering me an additional 3 months for $2. I accepted that. And I have found that I really enjoy it. My promotional subscription ended on 4/14/23, I downgraded the membership from premium to music only and kept it.

CarMax - I rounded the half-payment up to $250 as that is the amount I was saving towards my next car out of each paycheck before purchasing the Tucson. The new balance is $22,062.52. Edited to Add: On 5/5/23, while clearing my checking account transactions, I noticed that this payment had not hit my bank account. I logged on to CarMax, and there is no record of this payment. So annoying! I scheduled it again for today, and of course there is now more interest due. I just hate debt. The new balance is higher than it should be, at $22,086.68.

house DP - the amount I had available to contribute. The new balance in the fund is $1,161.51.

Broad - a loan repayment. The loan balance is down to $50 now.

life ins - my monthly life insurance premium.

end - the ending balance in my checking account.

So I went to the dentist on Monday for my bi-annual cleaning and it was time for x-rays. Bad news, I need a crown. My share of cost for that is $610, plus I will owe something for Monday. I will pay the dentist with my Citi MC, and then will have 2 paychecks to get the balance paid in full. Of course, this will impact my savings efforts which is frustrating, but it is what it is.