|

|

|

|

Home > Archive: May, 2023

|

|

Archive for May, 2023

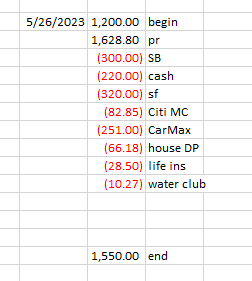

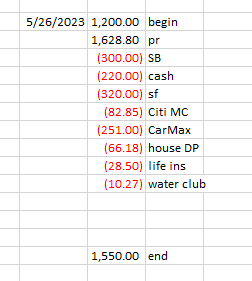

May 26th, 2023 at 11:59 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution to our joint living expenses

cash - cash until next payday

SF - automatic transfers to sinking funds scheduled for 5/30/23

Citi MC - the balance this time covered 3 bills: Verizon, Netflix, and Sirius XM.

CarMax - a payment towards my car loan. I thought it would be fun to add another dollar every time, so that's what I did. The new balance is $21,645.14.

house DP - a contribution to my house down payment fund. The new balance is $1,398.71.

life ins - monthly life insurance premium

water club - my tab for the water club at work

end - ending checking account balance. I now have $550 set aside for my pending dental bills.

And that is it, today's paycheck is spent.

Posted in

Budget By Paycheck

|

0 Comments »

May 23rd, 2023 at 11:04 pm

I had my first dental appointment for my crown this morning. The dentist said he was drilling deep and that when the novacaine wore off my jaw was going to be sore. He was sure right about that. (I went home afterwards and took a nap).

After he drilled, they did another xray. He said that he feels for best results, the tooth needs a root canal. Ugh! He referred me to an endodonist for that. My share of cost will be approximately $550, in addition to the $700 for the crown.

UPDATE: I ended up taking both Tuesday and Wednesday off from work, sick. I slept a lot, whimpering periodically.

Posted in

Spending

|

2 Comments »

May 20th, 2023 at 05:02 pm

Today I transferred $313 out of my ins/reg fund to pay the 5th wheel registration. I also transferred $406.65 from my Gilligan fund to pay for the vet bill to have him neutered. I also sent proof of neuter off to the shelter last week, and returned my signed adoption contract via email yesterday. Gilligan is officially my dog.

I just hate it when my savings balance goes down instead of up, but of course the money had been set aside for those particular expenses.

Posted in

Spending,

Sinking Funds

|

2 Comments »

May 18th, 2023 at 10:51 pm

My SnugglyBumps has been working on a project. He decided that he wanted to open an online store. He designed a cover, put it on a hardback notebook with good quality paper, and his link has gone live on Amazon.

He has some additional products in the pipeline which are not ready for sale just yet.

Here is his cover, a tribute to our sweet Nala Jean:

Please note: I am just sharing. This is not an attempt to sell a product. I am rather impressed with his creativity.

Posted in

Uncategorized

|

3 Comments »

May 12th, 2023 at 11:07 pm

So as you know, I have decided I want to retire to the place both of my kids are now living. Exactly when has been up in the air. Lately, I have been thinking that at 56.25, I am not so very far away from 59.5, that magic age where carefully following 72t rules will no longer be required. So, why not try to plan my retirement date around that? Can I make it work? I have been crunching numbers, and I think that I can.

If I work from now until age 59.5, I calculate that my monthly CalPers pension will be $946 per month. Of course, it won't begin until I have reached 62, so that is 2.5 years of living on savings only.

I have a spreadsheet (I have shared it before) that calculates my tax-deferred balance as I begin taking withdrawals. My goal is to still have money at age 100. Of course, I have to assume some rate of return, which may prove to be inaccurate. I use 5%, which I think is very reasonable. But still, as there is no guarantee, I like to build in some buffer. For example, I have built in a 3% annual COLA. If we hit some years of very bad market returns, I can reduce it or forego it completely for a year or two, which certainly helps prolong the life of my portfolio. When I calculate, I use the "rounddown" function, which also builds in some buffer. So if I begin at age 59.5 with a 2k per month withdrawal, increase it at 3% annually, decrease it at age 62 by the amount of my pension (which also has an annual COLA), and project out to age 100, I still have 274k at the end. I feel pretty safe with that. I am not calculating in any SS benefits, even though I do expect to receive a small amount. I intend to enroll when I reach age 65, so that I can have my Medicare premium deducted from it.

So 2k per month is not a fortune to live on, but I feel I can make it work. And, work well enough to lead a very happy life in the same area where my kids are. I have some time yet to investigate various costs and play around with that 2k per month budget.

One thing that would absolutely need to happen is my car loan would need to be paid in full by age 59.5. So, I have played around with those numbers. If I continue paying $250 per paycheck for now, then bump it up to $268 per paycheck after I receive my Step raise in September, then bump it up to $296 per paycheck after I receive my Step raise in September 2024, I will pay the loan in full on 7/30/26, exactly 2 weeks before I turn 59.5. That is a very doable plan and does not represent a hardship of any kind. So that piece of the plan is ironed out.

Now there is the small matter of a house. I want to be realistic about how much I can save. Things always seem to come up, like needing a crown. However, if I take the balance I have right now and add $225 to it each and every paycheck between now and the end of July 2026, I will have over 21k. I think that I can average more than $225 per paycheck. In fact, I think I can easily break 30k . However, I do not think I can have 50k saved up in only 3.25 years. Frankly, I am not too sure that you can buy a 50k house and take a 20k mortgage. Maybe you can? I would think that a lender wouldn't want to bother. Or maybe a HELOC for the 20k would be an option. Or, I could pull 20k out of my Roth. My Roth isn't huge, so I don't really like that idea. And what if the ideal house ends up being 65k? For sure I would want to look at borrowing some of that; 35k would be too much to pull from my Roth.

So it may be that if I am looking at having to carry a small mortgage, I will decide that 2k is simply not enough and I need to work a bit longer, save a bit more money, and let my pension increase a little bit more. If that is how it goes, then I will have to adjust. However, I am going to aim for 59.5 and see if I can hit it.

Posted in

Retirement Dreams

|

5 Comments »

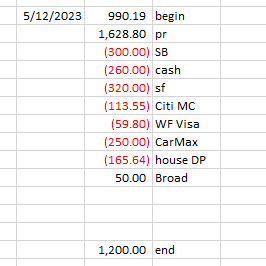

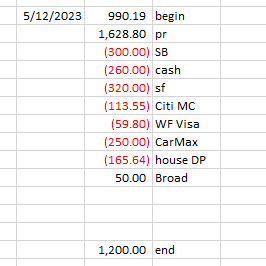

May 12th, 2023 at 09:58 pm

begin - my beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - cash for gas, personal, and misc

sf - automatic transfers to sinking funds scheduled for 5/16/23

Citi MC - the balance this time included $52.68 for gas, $33.33 for Papa Murphy's, and $27.54 for groceries at Safeway. We house sat last week, plus Birth Mom was here for a visit. We spent more than usual for groceries and take out.

WF Visa - the balance included $51.35 for Gilligan's flea meds and $8.45 for a set of 4 drinking glasses at Wal-Mart.

CarMax - my car payment. The new balance is $21,854.65.

house DP - contribution to my house down payment fund. The new balance is $1,332.53.

Broad - the last $50 owed, expected next Friday 5/19/23

end - my ending checking account balance.

I realized that I have longer to save for my crown than I had thought at first. It will take 2 appointments to complete the crown, then they will bill my insurance, then finally after the insurance pays they will bill me. I will use my Citi MC to pay the dentist then have at least 1 paycheck, possibly 2, before the statement due date. I have not even had the first appointment yet. $200 is enough to set aside from today's paycheck.

And that's it, today's paycheck has been spent.

Posted in

Budget By Paycheck

|

1 Comments »

|