|

|

|

|

Home > Category: 5th Wheel Loan

|

|

Viewing the '5th Wheel Loan' Category

March 24th, 2021 at 02:06 pm

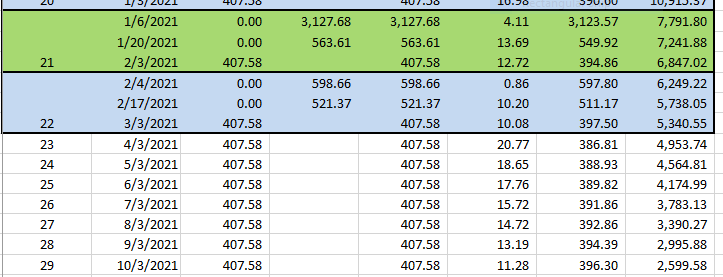

It's been fun, 5th wheel loan. Hasta lu bye-bye.

Posted in

5th Wheel Loan

|

8 Comments »

March 3rd, 2021 at 02:18 pm

or number 17 since the refinance.

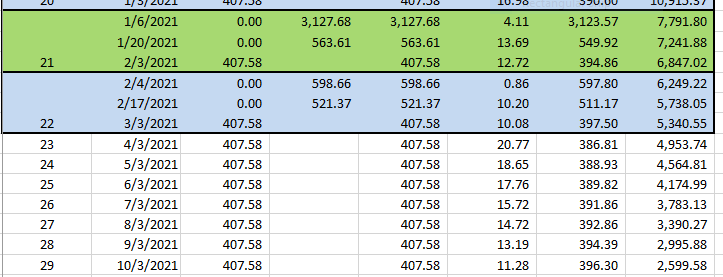

The regular monthly payment posts today, 3/3/21, bringing the principal balance down to $5,340.55. Since the previous regularly scheduled payment, I managed to pay an extra $1,120.03, all from regular monthly income. The last payment date has moved up to 5/3/22; that is 1 year and 2 months to go if going forward I pay only the regular monthly payments.

At this point, I have enough in checking and savings to pay the loan in full, with about 1k to spare. I'm not going to do it just yet, but this loan isn't going to be around much longer.

Posted in

5th Wheel Loan

|

1 Comments »

February 25th, 2021 at 02:40 pm

Look at what I can do this morning, after MONTHS of not being able to:

I don't know if it is because someone finally addressed whatever was wrong or if something reset itself or what, but I am so delighted! Who-hoo!

Posted in

5th Wheel Loan

|

3 Comments »

February 3rd, 2021 at 01:58 pm

or number 16 since the refinance.

The regular monthly payment posts today, 2/3/21, bringing the principal balance down to $6,847.02. Since the previous regularly scheduled payment, I managed to pay an extra $3,691.29. About $1,900 of that came from sinking funds, $600 from my stimulus payment, and the rest from my paychecks. The last payment date has moved up to 8/3/22; that is 1 years and 6 months to go if from this point forward I pay only the regular monthly payments.

I have given up on the pictures. I have tried using other browsers and using "incognito" web pages as the tech suggested. Still nothing happens. I don't know that I will ever be able to do my budget review entries. Frankly, it makes me lose a great deal of interest in keeping this blog; the entire point is to use it to track my finances and I can't do it the way I would like any longer.

Posted in

5th Wheel Loan

|

4 Comments »

January 3rd, 2021 at 03:24 pm

or number 15 since the refinance.

The regular monthly payment posts today, 1/3/21, bringing the principal balance down to $10,915.37. Since the previous regularly scheduled payment, I managed to pay an extra $1,363.03. The last payment date has moved up to 6/3/23; that is 2 years and 5 months to go if from this point forward I pay only the regular monthly payments.

Still no ability to upload pictures, so my "5th Wheel Amortization" page can still not be updated.

Posted in

5th Wheel Loan

|

2 Comments »

December 4th, 2020 at 03:35 am

or number 14 since the refinance.

Well, I decided to pull a chunk out of savings and pay it on the loan. I am just SO impatient to get it paid in full.

The regular monthly payment posted on 12/3/20, bringing the principal balance down to $12,640.14. The last payment date has moved up to 10/3/23; that is 2 years and 10 months to go if from this point forward I pay only the regular monthly payments. If I were able to upload pictures, I would update my "5th Wheel Amortization" page. But, our ability to upload pictures seems to be gone, so I won't.

Posted in

5th Wheel Loan

|

1 Comments »

August 8th, 2020 at 02:18 pm

or number 10 since the refinance.

The regular monthly payment posted on 8/3/20, bringing the principal balance down to $27,142.63.

Since the previous regularly scheduled payment, I managed to pay an extra $783.04.

The last payment date has moved up to 1/3/27; that is 6 years and 5 months to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

1 Comments »

July 10th, 2020 at 01:23 am

or number 9 since the refinance.

The regular monthly payment posted on 7/3/20, bringing the principal balance down to $28,225.67.

Since the previous regularly scheduled payment, I managed to pay an extra $745.61.

The last payment date has moved up to 4/3/27; that is 6 years and 9 months to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

2 Comments »

June 5th, 2020 at 01:15 am

or #8 since the refi.

Well, another regularly scheduled payment has been made. The new principal balance is $29,270.38. So glad to be under 30k!

Since the previous regularly scheduled payment, I managed to pay an extra $907.46.

The last payment date has moved up to 7/3/27; that is 7 years and 1 month to go if from this point forward I pay only the regular monthly payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

1 Comments »

May 3rd, 2020 at 11:55 pm

or #7 since the refi.

I haven't done one of these updates in 3 months, and some solid progress has been made in the interim. During the past 3 months, I managed to pay an extra $3,559.95.

The new principal balance is $30,468.52. I have now passed the 1/3 repaid point. Super glad about that!

The last payment date has moved up to 10/3/27; that is 7 years and 5 months to go, assuming no further extra principal payments.

My "5th Wheel Amortization" page has been updated, if you care to take a peak.

Posted in

5th Wheel Loan

|

0 Comments »

March 7th, 2020 at 05:16 pm

On Thursday my new dentist confirmed that a partial would work for me. So, that is the route I am going. I realize it will be an adjustment to get used to wearing it, but lots of people do it and I can do it too. The cost for a partial is about $1600 before insurance pays their portion. Currently, there is a balance of $2232.79 in my dental sinking fund. I will wait until all is done and paid for, then throw the remaining balance at debt.

Yesterday was payday and I was able to send $248.29 off to the 5th wheel loan, bringing the balance down to $34,351.95. It feels great to make a little progress.

We fly to Florida Tuesday morning and sail on Wednesday. We are not canceling our trip due to the current panic, which I personally feel is blown way out of proportion.

The cruise line sent an email stating that we can cancel for a 100% credit towards another sailing if we wish. We don't. Also, they are crediting us $200 per cabin as a thank you for not canceling.

Our ship is the Caribbean Princess. So I guess if you hear that the Caribbean Princess has been detained someplace, you'll know what is going on with me.

Posted in

Travel,

5th Wheel Loan

|

7 Comments »

February 17th, 2020 at 07:59 pm

This entry is very overdue. Loan payment #9, or #4 since the refinance, has posted. The new principal balance is $34,868.16.

Since the previous regularly scheduled payment, I managed to pay an extra $1,668.98.

The last payment date has moved up to 10/3/28; that is 8 years and 8 months to go.

When I went for my dental cleaning, the hygienist asked if I had considered a partial. I am going to discuss it with the dentist when I go for my next filling.

My birth mom has been here visiting for the past 2 weeks, which included my birthday. She has recently given up her apartment and is, for now, completely nomadic. I am so jealous! I hope that she enjoys this next chapter of her life. She plans to be back this way in a few months, so we will see her again then.

Posted in

5th Wheel Loan

|

2 Comments »

January 14th, 2020 at 02:11 pm

Made another principal payment yesterday in the amount of $1,668.98. Balance is down to $35,183.28.

I also had a dental visit yesterday. The dentist I had been seeing left the practice some months ago. The new dentist has a new treatment plan. This new plan includes two crowns and prep to do implants, which I will need to have done elsewhere. My share of cost is $5,400 plus whatever the periodontist charges for the implants. So, we are talking about a large dental bill.

Background: I have ruined my teeth with vitamin C drops and cough drops by having one in my mouth constantly. I have used this method to cope with my constant persistent cough. (I switched to only sugarless cough drops with no citric acid, but the damage was already done.) In the past year, I have had 3 extractions and 8 fillings. I still need more fillings and a deep cleaning, below the gum line. Previous dentist recommended doing a little at a time, which I had been doing.

The dentist wants to begin right away. I made an appointment 2 weeks out, but may cancel. I am not certain I wish to proceed. I think I may try to find where the previous dentist went. SB said I should also consider Mexico.

Also, the extractions were all in the back of my mouth. Two on the lower left and one on the lower right. So I don't APPEAR to be missing any teeth.

I think I am going to stop my extra principal payments for now and save the money instead, until I have a plan of action for my teeth.

Posted in

5th Wheel Loan

|

6 Comments »

January 3rd, 2020 at 02:03 pm

or payment #3 since the refinance.

My automatic payment of $407.58 has posted. The new principal balance is $36,806.23. I have now paid off more than 20% of the original balance.

Since the previous regularly scheduled payment, I managed to pay an extra $5,883.06.

The last payment date has moved up to 4/3/29; that is 9 years and 3 months to go.

Posted in

5th Wheel Loan

|

3 Comments »

January 1st, 2020 at 04:45 pm

Twice over the last few months I have had a vet bill to pay for Bella. I budget $0 for Bella's expenses. Obviously, she costs more than $0, so this has to change. However, I am loathe to increase my total sinking fund transfer.

Looking over my sinking funds and account balances, I decided to trim bi-weekly transfers as follows:

clothing - from $23.07 to $20.00

eGadgets - from $11.55 to $10.00

gifts/Xmas - from $38.46 to $28.46

hobbies - from $3.85 to $3.00

thereby freeing up $15.47 bi-weekly to set aside for Bella's expenses (excluding her food), while leaving my total bi-weekly transfer amount unchanged at $230. So we will see how this works out.

Additionally, I have decided to use the money in car replacement towards debt. Between us, we do have 4 vehicles, 1.5 of which are mine. While my daily driver is now 12 (!) years old, it has 140k ~ish on the odometer, is a Honda, and receives regular maintenance. I expect to be driving it for a good long while yet. However, I do want to beef up my car r&m fund to handle any large repairs, just in case. After the 5th wheel loan is paid in full, I can focus on saving up for my next car.

So, my plan is to transfer $1500 from car replacement into car r&m, leave $1 in car replacement, and apply the balance of $6,342.42 towards the 5th wheel loan.

My goal with the 5th wheel loan is to have the balance down to 23k by the end of 2020; paid in full by the end of 2021. I expect this last will require dipping into my emergency fund, possibly even wiping it out. I am willing to do so only if it pays the loan in full.

Posted in

Sinking Funds,

5th Wheel Loan

|

0 Comments »

December 26th, 2019 at 10:46 pm

Have your heard about this new company Trademore? Text is https://www.trademore.com/?gclid=EAIaIQobChMIz_bP37HU5gIVkYbACh0CKwHqEAAYASAAEgKDL_D_BwE&gclsrc=aw.ds and Link is https://www.trademore.com/?gclid=EAIaIQobChMIz_bP37HU5gIVkY...

They buy and sell used phones. I have a couple lying around; if they will buy them at any price, I will be happy to mail them off in prepaid mailers and have them out of my hair. I wouldn't mind having an extra dollar or two either (for debt repayment purposes, of course).

I don't buy expensive phones, so I'm not certain if they will want mine. But, we shall see.

Tomorrow is payday; since I know I want to pay an additional $572.87 towards my 5th wheel loan and since the funds are available, I pulled the trigger a day early. I lost $69.61 to interest leaving $503.26 to reduce the balance down to $42,170.90. I have now paid off 10% of the original principal balance.

Posted in

Income,

5th Wheel Loan

|

2 Comments »

December 18th, 2019 at 08:52 pm

I have just paid my car & 5th wheel insurance 6 month premium, so I thought this would be a good time to take a close look at my insurance and registration sinking fund.

Projecting the balance through all of next year, ignoring interest earned, it looks like I will have enough to cover both insurance premiums and both registrations next year, with the lowest balance at any point being $288.64. This is more than is needed. I intend to transfer $188.64 to checking and use it towards my next extra principal payment. That still leaves a cushion of $100 plus interest earned, which in my view is plenty.

Posted in

Sinking Funds,

5th Wheel Loan

|

1 Comments »

December 13th, 2019 at 02:10 pm

Today is payday, so that means another extra principal payment. I was so excited about getting to pay it, I could hardly get to sleep last night!

It had been 10 days since my last payment and $53.87 of interest had accrued. I calculated I had $310.77 extra, which left $256.90 to reduce principal. The balance is down to $42,674.16.

Another month's payment has been eliminated; the last payment due date is now 2/3/31.

Posted in

5th Wheel Loan

|

1 Comments »

December 3rd, 2019 at 06:36 pm

or payment #2 since refinance.

The regularly scheduled payment of $407.58 happened today, bringing the principal balance down to $42,931.06.

Since the previous regularly scheduled payment, I managed to pay an extra $1,039.96.

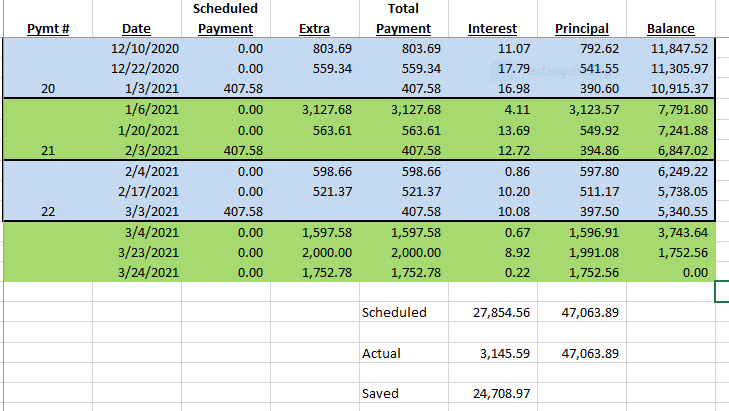

If I never pay another extra cent, the last payment will happen on 3/3/31. The total interest paid will be $13,735.76, a savings of $14,118.80 from the originally scheduled interest of $27,854.56.

I am including a snip of my spreadsheet here, since it is not showing up in "My Pages".

Posted in

5th Wheel Loan

|

0 Comments »

November 27th, 2019 at 09:49 pm

Today is payday and that means it is time for another principal payment. They never seem to be as large as I would like for them to be.

Today I calculated that I had $208.82 available to send off to principal. I logged on, scheduled the payment for today, and voila, I am somewhat less in debt.

The final payment moved up a month to 3/3/31.

I have now eliminated more than half of the originally scheduled interest. Mostly by refinancing, but still.

It snowed yesterday evening and more is expected. SB took our travel trailer and Bella and headed down to my mom's yesterday, to avoid pulling it in the snow. I will head that way too directly from work tonight. The snow should be gone before we go home, probably Sunday.

Have a wonderful Thanksgiving weekend with your loved ones, SA friends!

Posted in

5th Wheel Loan

|

5 Comments »

November 15th, 2019 at 04:38 pm

Today is payday, and my paycheck is received via direct deposit. My checking account balance this morning after my cash withdrawal was $2,454.54. From this, I need to subtract my sinking funds transfer ($230) and my dentist bill ($393.40, charged to Citi double cash MC yesterday) and then leave 1k in checking. That means there is $831.14 available.

I logged on to my bank account and transferred $831.14 to my 5th wheel loan. I have calculated the interest due* and updated my spreadsheet and my sidebar. I will check in a few days to see if my calculation is correct or if I need to adjust.

*Bank of the West deducts accrued interest first from any payment, then applies the remainder to principal. This is not as advantageous as what I have previously experienced, that interest is paid only from the regular payment and any extra payment is applied 100% to principal.

My final payment date is now 4/3/31, 6 months ahead of schedule.

Posted in

5th Wheel Loan

|

4 Comments »

November 14th, 2019 at 07:24 pm

For me, this was the deciding factor in how big a priority paying off the 5th wheel loan needs to be.

If I were to retire NOW, I calculate that I could draw $1,456 per month from my nest egg. Here is how that budget would look:

Everything I need, but not much fun. Without the 5th wheel loan payment, I could increase those sinking fund contributions and have more discretionary dollars. In short, my financial situation would be greatly improved.

Plus, I intend to cancel my life insurance policy once the 5th wheel loan is paid in full, freeing up a few dollars there as well. No one depends on my income any longer. However, in the event of my death, I would want SB to be able to have the 5th wheel free and clear. My children are both self-supporting and will inherit my investment and bank accounts.

So, I am happy with this plan. It makes sense to me.

Posted in

Budgeting,

Retirement Savings,

Retirement Dreams,

5th Wheel Loan,

Retire Now

|

4 Comments »

November 14th, 2019 at 05:28 pm

I have been mulling over how I want to prioritize paying down my 5th wheel loan. Do I not fund my Roth? Do I cut my sinking funds? Do I cut my 457 plan contribution?

I have decided the answers are yes, yes, and no.

I calculate that in 24 months or sooner, I can get the balance down to where I can pay in full from savings. This is what I am going to do.

I have cut both my travel sinking fund and car replacement sinking fund contributions to $0. I have trimmed both my car r&m and car ins/reg sinking fund contributions slightly, but they should still be adequate. This brings my bi-weekly transfer to sinking funds from $380 to $230.

I will not fund my Roth IRA for now. I will leave my 457 plan contribution where it is, 10% of gross.

(I will still take the Panama Canal cruise with my mother. She is looking forward to it and I am not going to take that away from her. She is turning 87 next month, so who knows how much longer she will be able to travel. Currently, there is almost 4k in my travel sinking fund which will more than cover it.)

24 months from now, the 5th wheel loan balance should be under $16,962.08, the current balance in emergency fund + car replacement fund. At that point, I will use as much of them as needed to pay the loan in full. (But not sooner, as I don't want to be without them PLUS still have a loan payment to make). At that point, I will turn my focus to re-building savings.

Posted in

Budgeting,

Sinking Funds,

5th Wheel Loan

|

1 Comments »

October 18th, 2019 at 12:54 pm

or #1 since the refinance.

This month I managed to scrape an additional $224.01 to principal. This brings my remaining payments to 142, or 11 years and 10 months, with one of those being less than a full payment.

If amortization tables interest you, you may notice that I have Frankensteined the old and new loan amortization together. (Amortization table available for viewing under "My Pages"). It just made sense to me to do it that way.

I did receive a refund of $480.88 from my original lender. I am hanging on to $400 of it (in checking) as I have a dental appointment coming up and I expect to owe about that to the dentist. The remaining $80.88 is part of the $224.01. (I have a Health Care Reimbursement Account for medical expenses, but I have just had more of them than usual this year between some dental work and my first ever pair of prescription glasses. The money is nearly depleted for this year).

November is a 3 paycheck month so I expect to pay an additional $800ish next time. That's going to be FUN, I'm looking forward to it.

Posted in

5th Wheel Loan

|

3 Comments »

October 4th, 2019 at 03:36 am

Originally Published 9/20/19

I signed the docs for my re-fi today. The new terms are as follows:

Principal 45k

Rate 4.58%

Term 12 years

Payment $407.58, to be automatically withdrawn from my checking account monthly beginning 11/03/19.

They waived the $399 fee, charging me only $15 to add their name as lienholder. My current lender gave a payoff number before I made my most recent payment, so they had the payoff as $44,985.00. I should receive a refund from my current lender for $500ish once all the dust settles.

Yay, it feels good. Smile

Posted in

5th Wheel Loan

|

0 Comments »

October 4th, 2019 at 03:33 am

Originally Published 09/10/19

Yesterday's trip to the DMV was a success. So, with registration in hand, I submitted an application with Essex Credit to refinance my 5th wheel loan.

I expect that I may need to pay down the principal some. I bought the 5th wheel new and we all know what happens to the value as soon as it is used instead of new. I don't know the current value and I am not certain if they do 100% LTV or if it is less. Will just have to wait and see. What I do know is that I would much rather be paying 4.69% than 6.74%, so I will cough up whatever principal is needed to make it happen.

Posted in

5th Wheel Loan

|

0 Comments »

October 4th, 2019 at 03:31 am

Originally Published 8/28/19

The next thing I want to focus on in my quest to pay off the 5th wheel is to get the loan refinanced to a lower rate. My current rate of 6.74% is not horrible for an RV loan, but I feel I can do better. Reducing the interest just gets me there that much faster.

I found a lender (Essex credit, a division of Bank of the West) who will refinance at 4.69%, but I need to submit my DMV paperwork along with my loan application. Uh-oh, obstacle.

The home mail delivery is very unreliable in our neighborhood. Mail shows up late, or your neighbor drops it by because it was delivered to their house, or the most common is that it never arrives at all. Complaints have been lodged with the local Postmaster for years and years, but nothing changes. So, most people just have a PO box. We do too, and the DMV has this information, but they continue to use my home address for my mail.

I have never received my license plates, registration, or other paperwork for my 5th wheel.

My car registration expired last February, and I still do not have my new tags. They mailed me a second set in June (requested via telephone), which also never arrived. I know the first set was mailed to my physical address because they told me so on the phone. I suspect (but have not confirmed) that they did the same with the second set.

So I need to go to the DMV in person to take care of both items. I made an appointment and it is a couple of weeks away.

Posted in

5th Wheel Loan

|

0 Comments »

October 4th, 2019 at 03:28 am

Originally Published 8/24/19

Everything is paid for August, so it was time to make an extra principal payment. It is my habit to keep 1k in checking, then "sweep" all else towards whatever goal I am working towards. This month I was able to sweep $566.96, of which $147 was from a refund for DMV fees, and the remaining $419.96 was from regular income.

So that was a good month, and I hope to manage paying a similar amount every month, until it is done.

Updated snips of the amortization table are on my "5th Wheel Amortization" page, link in my sidebar.

Posted in

5th Wheel Loan

|

0 Comments »

October 4th, 2019 at 03:26 am

Originally Published 8/12/19

Now that I have decided to make paying off my 5th wheel loan a priority, I have been thinking about different strategies to get the job done.

One strategy I intend to pursue is to get a 0% no balance transfer fee credit card loan if I can. I have Googled a bit, and have found a couple of offers for 0% for 15 months, no balance transfer fee. If I were to borrow $4,200, that's a repayment of $300 per month for 14 months (I always plan to pay in full the month before the offer ends). It adds a bit more hassle to juggle both debts, but I would save an additional $334 in interest by paying a lump sum of $4,200 up front vs. paying $300 per month over 14 months.

So I will apply and see if I am approved or not.

A second item is that I have raided my Roth sinking fund. I had been depositing 5% of my gross pay to it each payday, with the intent to contribute the money in 2020 (I had already contributed the max for 2019). I am using part of the money for medical expenses (more on that later), and the remaining balance of $1,130.81 as an additional principal payment. I will schedule the payment as soon as the money hits my checking account.

Posted in

5th Wheel Loan

|

1 Comments »

October 4th, 2019 at 03:14 am

Originally Published 5/15/19

It would have been more practical to buy the 5th wheel our friends were selling, or some other used 5th wheel. But, I decided that I wanted the beautiful new 5th wheel with extended warranty.

So, I bought it. The same one in the pics I shared in my post "Tow Vehicle Purchased". We have not yet taken delivery. The dealer is installing a tankless hot water heater and slide out "toppers" (covers to protect the roof from leaves and dirt while the slide is out). Plus, we need to have a 5th wheel hitch installed in the truck bed. (Which of course can't happen until we get the truck back from the dealer. Grr!).

I am very pleased and looking forward to living in my new home. We will keep our current travel trailer as a "guest room" so that family & friends can come up and visit us.

My loan payments are $417 for 15 years; the interest rate is 6.74%. I have already found that a lender called Essex Credit, which is funded through Bank of the West, will refi me at 5.15%, dropping my monthly payments to $375. However, I will have to wait as they require copies of both a loan statement and DMV registration; I have not yet received either one. I had checked with Wells Fargo before taking the financing the dealer offered; WF's best rate on an RV loan is 11.59%, and goes up from there. I could not believe it. I think they must be wanting to get out of RV financing altogether.

I think I am just going to pay the loan one payment at a time and direct extra dollars into savings.

Posted in

5th Wheel Loan,

RV Life

|

0 Comments »

|