|

|

|

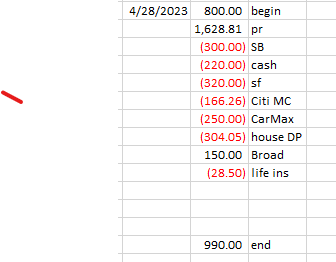

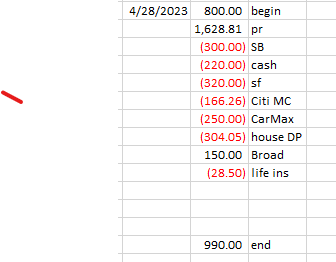

April 29th, 2023 at 02:52 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - My budgeted amount is $260, but I only needed $220. I forgot to adjust before I made my House DP transfer, so I ended up with an extra $40 in checking. I just left it there, because I will have a big expense to pay beginning with the next paycheck. More on that below.

sf - automatic sinking funds transfer which will happen on 5/2/23.

Citi MC - the balance on my Citi MC. It included $149.35 for a meal out, and $16.91 for Sirius XM. The meal out was dinner and drinks for 3. I have a couple of girlfriends from work, we all now work in different departments in different buildings. We meet up every month or two at a particular restaurant. We take turns paying, and it was my turn. The restaurant has gotten a bit pricey, as you can see. The Sirius XM is a new expense. When I bought the Tucson, 3 months were included free. Then I received an email offering me an additional 3 months for $2. I accepted that. And I have found that I really enjoy it. My promotional subscription ended on 4/14/23, I downgraded the membership from premium to music only and kept it.

CarMax - I rounded the half-payment up to $250 as that is the amount I was saving towards my next car out of each paycheck before purchasing the Tucson. The new balance is $22,062.52. Edited to Add: On 5/5/23, while clearing my checking account transactions, I noticed that this payment had not hit my bank account. I logged on to CarMax, and there is no record of this payment. So annoying! I scheduled it again for today, and of course there is now more interest due. I just hate debt. The new balance is higher than it should be, at $22,086.68.

house DP - the amount I had available to contribute. The new balance in the fund is $1,161.51.

Broad - a loan repayment. The loan balance is down to $50 now.

life ins - my monthly life insurance premium.

end - the ending balance in my checking account.

So I went to the dentist on Monday for my bi-annual cleaning and it was time for x-rays. Bad news, I need a crown. My share of cost for that is $610, plus I will owe something for Monday. I will pay the dentist with my Citi MC, and then will have 2 paychecks to get the balance paid in full. Of course, this will impact my savings efforts which is frustrating, but it is what it is.

Posted in

Budget By Paycheck

|

1 Comments »

April 23rd, 2023 at 06:38 pm

Look at this little house, isn't it cute?

Carbondale, IL Real Estate - Carbondale Homes for Sale | realtor.com®

And what do you know? It just happens to be located in the same town where my very favorite 2 people in the whole world live. What a coincidence.

Almost a year ago now, I re-named my "hobbies" sinking fund "house down payment". I have been adding small bits of money here and there. Well, I am ready to get serious about this sinking fund. Because I want to make a large down payment on my last house; 100% to be precise. The balance in the account at this moment is $857.46. While this is a lofty goal, notice that this little house is listed for sale at 49.9k. There is plenty for sale in the area in this price range.

I intend to stop making extra payments on my car loan for now. I intend to stop making Roth IRA contributions for now. I have always intended that my Roth would be long-term savings for something like a new roof or a vehicle replacement. I don't want to touch it for anything else. While 71k is not a huge sum of money, it is a fund I do not plan to tap anytime soon. I hope to need the house down payment much sooner.

I am only contributing 5% of my gross to my 457 plan. I will just keep doing that.

When will I make this move? I do not know. But I know that when the time comes, I want to be financially ready.

Posted in

Retirement Dreams

|

4 Comments »

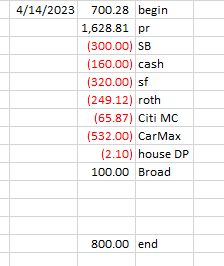

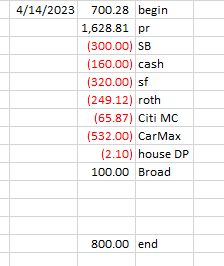

April 17th, 2023 at 02:39 am

begin - beginning checking account balance

pr - net payroll check

SB - my contribution towards our joint living expenses

cash - cash for expenses over the next 2 weeks

sf - automatic sinking funds transfers

roth - contribution to my Roth IRA

Citi MC - my Verizon cell phone bill and monthly Netflix subscription

CarMax - my latest attack on my car loan. The new balance is $22,270.24

house DP - a tiny contribution towards my house down payment fund

Broad - a loan repayment; $200 still to go

end - ending checking account balance

Posted in

Budget By Paycheck

|

0 Comments »

April 1st, 2023 at 07:24 pm

I have been meaning to talk a bit about how my CalPers pension works. The formula which will be used to calculate my benefit is:

Salary x Service Credit x Age Multiplier

The number used for "Salary" is the average of my highest 36 months. So each time I get a raise, it takes a full 36 months for the new salary to fully "bake" into the pension calculation. However, each month which goes by means a slightly higher "Salary" number.

The number used for "Service Credit" is my years of service in the CalPers system, calculated out to 3 digits past the decimal point. Every passing day in which I am an active employee increases my service credit slightly.

The number used for "Age Multiplier" is based on my age when I retire. I am in a "2% at 62" plan, which means that at age 62 my Age Multiplier is exactly 2. If I retire before age 62, my Age Multiplier will be less than 2; if I retire past age 62, my Age Multiplier will be more than 2.

I am already vested and am at least 50 years of age, which means that I can retire from CalPers at any time. However, my monthly pension payments will not begin until I reach age 62. I also have the option to forfeit my monthly pension and instead withdraw my contributions plus interest in a lump sum. One reason to consider opting for the lump sum is that because of the WEP (Windfall Elimination Provision), my eventual SS benefits will be reduced by half of the amount of my pension, up to the cap. For 2023, the cap is $557.50, meaning they cannot reduce my SS benefits more than by $557.50. When the time comes, I will have to calculate to determine which option is in my best interest. It seems to be that right now, the lump sum would be more beneficial. However, each passing day tips the scales slightly more in the favor of monthly pension payments.

If I were to retire today, my monthly pension payments would begin at age 62 and would be in the amount of $388.42. I would lose $194.21 in monthly SS benefits as a result. Or, I could opt for the lump sum which is currently 25k and change; there would be no reduction in SS benefits down the road.

If I were to work until age 62, my monthly pension benefit would be:

$5,916 x 11.7 x 2 = $1,384.50

Probably slightly more as I will likely enjoy a few cost of living raises between now and then.

So clearly, not a fortune, but when added to withdrawals from my nest egg and possibly a small monthly SS check, it will be enough to provide for my needs.

I had not wanted to work until age 62, but of course I will do what I need to do. So I just keep calculating, and when I reach the point I can afford to retire, I will know.

Posted in

Uncategorized

|

2 Comments »

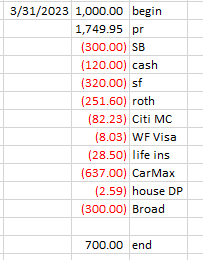

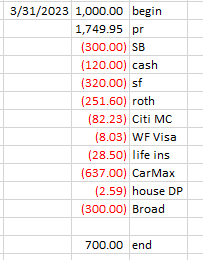

March 31st, 2023 at 01:36 am

Hello Everyone. 😀

Begin - beginning checking account balance

pr - my net payroll check. This being the 3rd paycheck of the month, it is a bit larger than usual. There are no deductions for medical on 3rd paychecks. A bit of extra money is, of course, always welcome.

SB - my contribution towards our joint household expenses.

cash - cash for gas, personal, and misc for the next 2 weeks. I still had $140 in my wallet, so only needed an additional $120. I have been teleworking so frequently that I just haven't been spending as much gas money. Plus, I used my credit card once for gas for the sake of convenience. I had Gilligan with me and wanted to just pay at the pump.

sf - automatic transfers to my sinking funds. These will occur this coming Tuesday.

roth - a Roth IRA contribution

Citi MC - the balance on my Citi MC. This includes a tank of gas ($56.64), credits used to solve puzzles on Conceptis.com ($12), and a quick lunch at Jack in the Box ($13.59). Can we just pause for a moment to say that fast food prices are getting quite high? I ordered a chicken sandwich, a medium lemonade, and a small plain hamburger for Gilligan. $13.59! I did not use cash because they were only accepting cards at the time.

WF Visa - hygiene products SB picked up for me at the grocery store.

life ins - monthly life insurance premium

CarMax - I was able to send $637 to my car loan! This amount includes an additional $405.99 towards principal. The new balance is $22,759.03.

house DP - a tiny contribution to my house down payment fund

Broad - a loan to a friend. This woman and I call each other "Broad". She was having a bit of a financial crisis, asked me for a loan, and I chose to lend it to her. I do feel confident she will repay me.

end - ending checking account balance.

And that is it; no more transactions until next payday.

Posted in

Budget By Paycheck

|

0 Comments »

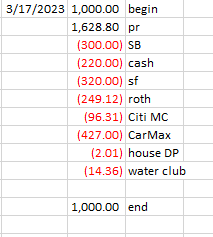

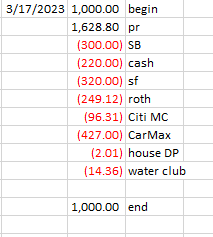

March 20th, 2023 at 12:51 am

Begin - beginning checking account balance

pr - net payroll check

SB - my contribution towards our joint living expenses

cash - cash for the next 2 weeks

sf - automatic sinking funds transfers

roth - contribution to my Roth IRA

Citi MC - payment for my Verizon bill ($50.38), Netflix ($15.49), prescription co-pays ($57.76), less redeemed cash rewards ($27.32)

CarMax - payment towards my car loan. This payment includes an additional $195.99. The new balance is $23,351.69.

house dp - A tiny contribution to my house down payment fund

Water Club - At work, we have a Water Club to pay for bottled water. It was time to pay.

Posted in

Budget By Paycheck

|

0 Comments »

March 4th, 2023 at 03:12 pm

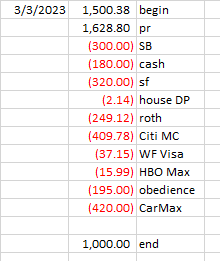

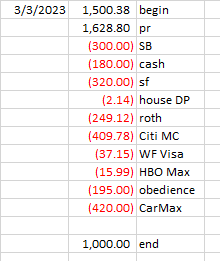

begin - checking account previous ending balance ($1,500) plus interest ($0.38)

pr - net payroll check

SB - my contribution towards joint household expenses

cash - coming in low again, mainly due to gas savings from teleworking

sf - automatic sinking funds deposits

house DP - a tiny house down payment fund contribution

roth - Roth IRA contribution @10% of gross income

Citi MC - the balance on my Citi MC. This amount includes a pen for Gilligan ($300.25), a collar and leash for Gilligan ($27.68), pizza ($40.00), and an Amazon order for toiletries ($41.85).

WF Visa - some items SB picked up for me

HBO Max - subscription fee for March

obedience - I found a local dog trainer with 30 years of experience. She is currently offering only private lessons at $65 per pop. I am setting aside enough for 3 lessons and I think that will be enough. We had a lesson scheduled for last Sunday, but the weather had other plans. Hopefully by next weekend we will be able to start.

CarMax - and that left $420 to throw at my car loan. I need to pay at least half of a payment ($231.01), so this amount represents an extra $188.99. It is progress, just not as much as I would like. The new balance is $23,733.63.

end - checking account buffer of 1k which just sits there

And if anyone is interested in trying Budgeting-By-Paycheck for themselves, I found this free printable template online: 16 Free Budget Printables to Save More Money - The Krazy Coupon Lady You have to scroll a little bit to get to the Budget By Paycheck template.

Posted in

Budget By Paycheck

|

3 Comments »

March 3rd, 2023 at 03:47 am

So here's a pic of my new car:

Can you see it peaking out from underneath all of that snow? It won't be going anywhere for awhile.

We went down to Rancho Cordova and stayed in a hotel for 2 nights, afraid that if we didn't we would get snowed in and stuck for the duration. We returned home yesterday. Of course, the power is out. Who knows for how long. Today is the 4th day. During the last big storm we had in late December 2021, we were without power for 14 days.

I have been teleworking. It's a good thing that I can, because it is expensive to stay elsewhere and I can't make the daily trek between work and home right now. The generator powers our Starlink, so internet is not a problem as long as we keep the generator running.

A new storm is rolling in this coming weekend and more snow is forecast.

This is another picture looking out towards the road, just because I think the sky is so pretty.

Posted in

Uncategorized

|

1 Comments »

February 19th, 2023 at 07:03 pm

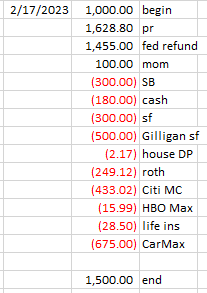

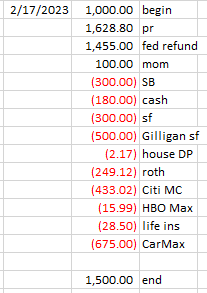

begin - my beginning checking account balance.

pr - my net payroll check.

fed refund - my federal income tax refund.

Mom - reimbursement for Netflix. It's been several years since she paid me anything for Netflix, and I really don't mind if she never pays a cent. She mailed me this check, so I deposited it.

SB - we agreed to increase the amount from $250 to $300. SB buys our groceries, buys our propane, pays the electric bill, pays the garbage bill, and pays for Starlink internet. This $300 is my contribution towards those costs.

cash - this is my cash allowance for gas, misc, and spending money. My budget for this is $260, but I had cash left from last time so reduced my withdrawal to $180.

SF - the automatic transfer to my sinking funds.

Gilligan SF - an initial deposit to save ahead for Gilligan's expenses.

house DP - a tiny deposit to my house down payment fund.

Roth - a contribution to my Roth IRA.

Citi MC - the balance on my Citi MC. It included Gilligan's adoption fee ($120), a visit to PetCo ($175.29), a bath for him in one of those dog wash vending machines ($10.00), dinner for two at The Olive Garden ($59.70), and then my Verizon and Netflix bills.

HBO Max - this is a new subscription so I can watch "The Last of Us". We have Amazon Prime which SB pays for, and this add-on automatically bills his card. I will reimburse him for this monthly.

life ins - my life insurance premium.

CarMax - the amount of money I had left to throw at my car loan. This payment brought the balance down to $24,107.86.

ending balance - I am holding on to an additional $500 as I am still shopping for a dog pen and obedience classes.

Posted in

Budget By Paycheck

|

2 Comments »

February 15th, 2023 at 05:11 am

Today I teleworked for the very first time. Overall, I really liked it. It was a bit of a challenge having only one screen (in the office, I have three), but that commute was terriffic! And my co-worker snored all morning.

So we used to put Bella in the neighbors' yard (they are tenants). They had 3 dogs; two males and a female. Time has passed, and two of them have also. There is one male left. He is an older black lab and he was not the pack leader. Well, he and Gilligan have met several times and he growls at Gilligan. Perhaps that will change once Gilligan has been neutered, but presently I am unwilling to leave him in the yard.

We are shopping for an outside pen for Gilligan. And looking for some obedience classes. For the neutering, we will wait awhile for him to settle in and learn to trust us.

I still miss my Bella, but it is nice to have another pet to love.

Posted in

Uncategorized

|

2 Comments »

February 11th, 2023 at 04:49 pm

This little guy was at the animal Shelter in Atwater, about 3.5 hours away. I saw this little face on Thursday evening, texted my boss to ask for Friday off, and drove down to Atwater yesterday. Meet Gilligan, our little buddy. The shelter estimted his age at 1 year and 1 month, mostly based on his teeth.

So much new for him yesterday, but we were pleased to learn that he is house-broken. He even woke us up during the night with one sharp, urgent bark (to go outside). SB has gone off to work this morning, Gilligan and I are snuggling and getting to know each other. He has some learning to do. He is unwilling to jump in or out of a car, so must be lifted. He wouldn't try our steps, so had to be lifted there as well. He needs to learn his name, and to stay, etc. It will come in time.

Posted in

Uncategorized

|

7 Comments »

February 4th, 2023 at 06:23 pm

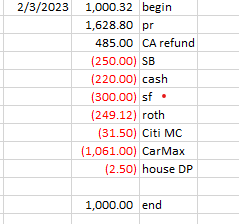

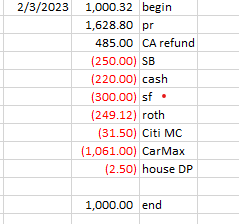

Here is yesterday's paycheck and budget:

With yesterday's payment, my car loan is down to $24,739.24. Still such a huge number, but moving in the right direction.

Posted in

Budget By Paycheck

|

1 Comments »

January 22nd, 2023 at 10:42 pm

When I went down to the central valley for my mom's surprise 90th birthday party, that same old nasty hacking cough came back. By the 3rd day there, I was coughing non-stop. It continued on for 5 weeks, then mercifully tapered off and is now back to normal. (I feel the urge to cough most of the time, but can mostly resist. I use cough drops to help control the urge.) I missed a bunch of work because I just can't function like that.

All of this background to say that I did not deal with selling my cr-v in a timely manner. The repair was only $400 odd dollars, which was a pleasant surprise. Then I started coughing so it just sat. Then when I was ready to deal with it, it had started making a noise (some sort of engine noise). I decided that I just did not want to deal with it any longer, and I did not want to sell it private party. I sold it to CarMax for $2,900. It is a relief to have it done. And considering the circumstances, I feel that the price was fair.

Before it started making a noise, I strongly considered keeping the cr-v and selling the Tucson, even though I would take a hit of several thousand dollars. I just do not enjoy having a car loan. But it did start making a noise, so I grudingly concluded that buying a newer car made sense, loan or not.

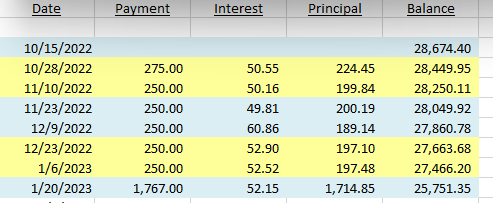

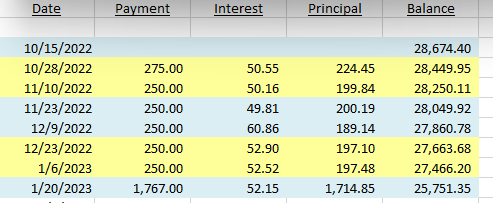

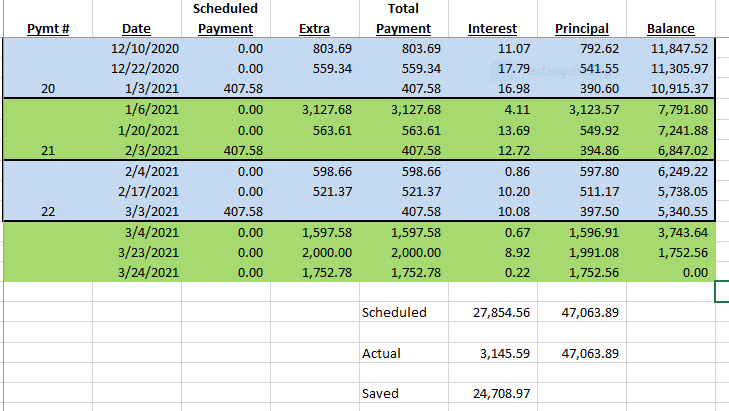

Some of the $2,900 proceeds went into savings and some went towards the Tucson loan. I just wanted to give a quick update on the Tucson loan. Here are the payments I have made so far:

I am impatient to get the balance down, so I can stop paying so much interest. I've lost $368.95 to interest already. I have now repaid my credit card and my savings for the extra expenses I've had the last few months and can start paying more towards the loan each payday.

Posted in

Uncategorized

|

2 Comments »

January 22nd, 2023 at 06:39 pm

I have recently stumbled across this YouTube channel. The host goes through people's account statements prior, then interviews people and discusses their financial information. These are generally people who aren't managing their money well and need some help.

It's an interesting show and I thought that people here might enjoy it.

Posted in

Uncategorized

|

3 Comments »

December 2nd, 2022 at 06:58 pm

My birth mom has been living a nomadic van life for several years now. She comes to our place for a visit several times a year, and typically stays for a week or so. She was here a couple of weeks ago; one evening she and I and SB were in the 5th wheel. It was about 8:30 pm, so already quite dark. Suddenly, we heard a bang and then a scraping sound and then a grunty sort of moan. It sounded like a bear. SB took a light and went out to investigate. Four eyes peered out at him from under the travel trailer (the 26 footer we lived in the first 2 years we were up here. It is parked right next to the 5th wheel; we use the fridge/freezer and to store food and other items. Plus, it is nice to have an extra bed and bathroom). The eyes belonged to two adolescent bears. Birth mom had some plastic tubs of food (canned and packaged) on the back rack of her van, parked right by the travel trailer. The bears had hauled the tubs underneath the travel trailer and were happily enjoying the contents. Did you know that a half-grown bear can bite right into canned foods? Well, they sure can. They left empty, mangled cans behind.

So we discussed whether or not birth mom should sleep in the 5th wheel that night (she prefers her van). We theorized that possibly the bears had lost their mama in the fire, or perhaps were newly independent from her. Eventually, the noises died down. SB went back out with a light (and bear spray!) and there was no sign of them. He walked birth mom to her van and she got in and locked up for the night.

During the next few days, we were fairly certain that the bears were making nocturnal visits, but there was no more thievery. Then one night, SB and I were awakened at approximately 3:30am by some loud noises. Birth mom had already traveled on at this point. I opened the shade for the window next to our bed. The window looks down on the travel trailer and I could see that the bottom half of the door was open, but the top half was not. It’s a one-piece door. They had pried the bottom open although the door was still in a closed position. As I was looking, a dark head poked out from underneath the travel trailer, then went back under. Soon a dark head poked out from the lower part of the door. Soon it was followed by a body, and that bear went under the travel trailer. They seem to prefer eating under there. Then one of them crawled out and went back into the trailer. Before too long, a third bear came along, much larger than the other two. So, they haven’t been separated from mama after all. Mama was too large to fit through the pried open bottom part of the door, but she grabbed the door and yanked on it hard (I was shocked that the lock held) and reached in. I’m not sure if she could reach what she wanted or if junior was pushing food towards her, but her arm came out and she held an entire case of canned food in one paw. She took it and walked off into the dark.

(Despite everything, I enjoyed watching them. They are beautiful creatures. It was a treat to observe them so close up, knowing I was safe.)

Of course, we have always known that if a bear really wanted to come into our home, it could. But bears are typically not quite that aggressive. (These are black bears, not grizzly). They will look through garbage cans and take any food left outside, but entering a place that smells like human is not something they will generally do. In the summers, we sleep with our door open (screen closed) and have never had any animal encounters.

This sort of occurrence continued nightly for a week or so. We put ammonia around everywhere which is supposed to be a deterrent. It’s apparently not. SB sprayed them twice (bear spray is a very strong pepper spray). They ran off, very unhappy, but were back within a few hours.

We called 911 twice. The first time deputies came out and looked around, but the bears were long gone. The second time the deputy called back and said it would be about 2 hours before he could come, he would like to just forward the call to the Dept of Fish & Game if that was OK. We said that was fine. A Fish & Game agent called back the next day. It turns out that Fish & Game no longer re-homes bears. The agent said that the survival rate was less than 50% so they have stopped the practice. He recommended shooting them with paintball guns. Also, we could apply for a depradation permit. Since there was property damage, we would likely be approved. That means you have permission to kill the bear. Well, we were calling because we wanted them re-homed, not killed. (We hadn’t realized there was a low survival rate for re-homed bears).

Finally, they went through all of the food in the travel trailer. They haven’t been back in several nights. I hope it is over for now. It’s getting colder and snowed last night; they should hibernate soon. I fully expect they will be back in the spring. I don't know what we are going to do about the door. It is an older travel trailer, it might be hard to find a replacement door. We can still use it for storage, but no more food storage.

Posted in

Uncategorized

|

4 Comments »

October 26th, 2022 at 03:53 pm

Well, just look at this! My blog is one of the newest on the site! I started it in December 2010, so I guess that's pretty new? This is unimportant, it just kind of cracked me up.

Posted in

Uncategorized

|

5 Comments »

October 23rd, 2022 at 06:25 pm

Maybe a year or so ago, I stumbled across a You Tuber named The Budget Mom. She has a website and sells some products and recently wrote a book. She promotes a budgeting method called Budget By Paycheck. I started using it and find it simple yet effective. It is just a zero based budget for every paycheck.

Here is my planned budget for my paycheck this coming Friday:

| 10/28/2022 |

1,000.00 |

begin |

| |

1,595.30 |

pr |

| |

1,055.74 |

from sf |

| |

(250.00) |

SB |

| |

(300.00) |

sf |

| |

(260.00) |

cash |

| |

(244.24) |

Roth |

| |

(28.50) |

life ins |

| |

(77.53) |

WF Visa |

| |

(1,215.77) |

Citi MC |

| |

(275.00) |

CarMax |

| |

1,000.00 |

end |

I am just using Excel. I had been throwing the odd dollars and cents leftover into a sinking fund called "House Down Payment". As you know, both of my kids have purchased homes in southern Illinois. I don't have a definite time line, but there is no question in my mind that my fondest wish is to be where they are. However, the new recipient of every spare cent I have will now be my car loan.

Edit: A few words about the line items in my budget ~

begin - I keep a 1k buffer in checking, just in case I need some quick access.

pr - My net payroll check. My share of my health insurance premium and a 5% contribution to my 457 plan are already taken out.

from sf - Transfers in from my sinking funds to cover expenditures.

SB - I give SB $250 every payday. He buys all of our groceries, buys gasoline for the generator, and pays our electric bill. And Starlink internet. Seeing this in writing, perhaps he and I need to discuss if this amount is sufficient.

sf - Automatic transfers to sinking funds, which happen a few days after payday.

cash - This is spending money, gas money, and misc things from the drug store (hair products, vitamins). I don't always make it without putting a tank of gas or other item on the Citi MC.

Roth - I contribute 10% of my gross to my Roth IRA.

life ins - Automatic deduction for my term life insurance premium.

WF Visa - I don't use this card, but SB has a second card in his wallet. He uses it on occasion when I ask him to pick something up for me, or if he has run errands for me and I wish to buy him some gas. It's just a convenient way for me to pay without us trading money.

Citi MC - This is the payment I will be making on payday. Unfortunately, it is not the entire amount currently owed. However, I have not yet been billed for these charges so I have some time yet to pay without owing interest. I try to pay my balance to $0 every payday, whether it is due or not. My phone bill, Netflix, and now Discovery Plus all are on autopay to this card.

CarMax - A car payment; the first of many.

end - The 1k buffer for next time.

Posted in

Budget By Paycheck

|

3 Comments »

October 23rd, 2022 at 04:29 pm

It was my hope to never take another loan in my life with the possible exception of a mortgage at some point. Before the CR-V began giving me trouble, I had begun setting aside $250 each payday earmarked for my next vehicle, and had amassed 2k. That became my down payment.

The price of the vehicle I purchased was $26,988. I opted to buy an extended warranty. With tax and registration the total purchase price was $30,674.40. That's sure a lot of money for a car.

After driving it for a week, I have to say I really do like the car. The keyless entry and start is really nice and convenient. The backup camera and lane change assist are wonderful. I believe it was Monkey Mama who mentioned that going from a 2008 model to a 2018 model would be a substantial upgrade in safety features and I have definitely found that to be true.

So now comes the small matter of actually paying for the vehicle. I opted for a 72 month loan with an interest rate of 4.95%, making the monthly payments $462.02. CarMax Auto Finance is the lender. The first payment is due 11/28/22. I get paid every other Friday, with my next pay date being 10/28/22. I read on CarMax's website that they allow split payments so long as the minimum amount due is received in full by the due date. So my plan is to pay at least $231.01 every payday, beginning this coming Friday. I am going to break my personal rule of no "pull" transactions from my checking account and submit the payments on CarMax's website (rather than from my bank's website). I want the payments to process immediately, not days later. I want to shave off every penny of interest expense possible.

I have a lot of extra expenses to pay off right now. The vet bill last Saturday was $1,163, I have made hotel room reservations for December, I am planning a party, I am paying car insurance for two vehicles right now. These expenses go on my Citi MC so now I need to get them paid in full before interest accrues. I have tapped my sinking funds to help pay and should be able to pay in full before the due date without tapping them further. We'll see.

For this coming Friday, I have scheduled a payment of $275.00 to CarMax. It's a start.

This has been a busy week and I have been grieving for my sweet girl and I am just worn out. Today is a take it easy day. I'm watching TV (old episodes of Sister Wives on Discovery Plus), puttering around online, and cross-stitching. SB is at work today, but will be home around 8pm.

I got the biopsy results on my uterine polyps and they were benign. All is well there.

Posted in

Car Loan Update

|

3 Comments »

October 16th, 2022 at 05:41 pm

I did buy that car yesterday. And then the day took a horrible turn.

We went to my niece's and while there, my sweet Bella began struggling to breathe and foaming at the mouth. I took her to the closest emergency vet where they immediately put her under anesthesia, intubated her, and took xrays. The vet said she had advanced pneumonia and it was too late to treat her. I feel horrible because I hadn't even known anything was wrong. We stopped at her favorite park that morning and she ran about happily. She devoured her breakfast. She seemed perfectly fine and healthy. And now she is gone. She was only 5.5 years old.

I can't stop crying.

Now I have to go home to a place that will feel horribly empty and unbearably sad.

Posted in

Uncategorized

|

13 Comments »

October 14th, 2022 at 09:33 pm

My car was left at the repair place yesterday as I was not able to drive following my procedure. So earlier today, SB and I hopped in his car and drove down to Placerville to pick it up. The shop didn't charge me a cent, even though they had checked it out. That was a pleasant surprise. It started right up and I drove home, no problem. After SB got home, he said he was going to drive it down to the shop (the big metal shop with tools and equipment on his property) and wash it. Well, guess what? It would not start. Apparently it needs to sit overnight before it will start. SB thinks that this is going to be an expensive problem to diagnose and repair. So, that's it. I am breaking up with my car and moving on.

You know, about 6 months ago, SB mentioned I should consider selling my car while it still has value and buy something else. I scoffed. I intend to drive this for years yet, I said. Oh, I just hate it when he is right!

I can sell to Junkcars.com as is for $1,074. I was very honest about the problem. It's kind of a bummer, but I don't have to put any money into repairs and I don't have to lie about it. (Which of course I won't lie to a potential buyer). I just spent $800 odd dollars two months ago putting on new tires. Bleah!

Update: I am not going to sell it to junkcars.com. At least, not yet. I am going to take it to a mechanic, drop it off, and let him figure it out at his leisure. If it can be repaired, then I can sell it private party for more than $1,074.

So here I am, I need a car right away. I kind of like CarMax, I feel that they have a big selection and they are upfront about prices and they don't play games. So I hopped on their website and looked at a few options. I need AWD and I need something with clearance, so that basically means an SUV. My preference is a Honda or a Toyota, but I didn't see anything that said screaming good deal to me. So then I just searched for any vehicle with AWD and I found a 2018 Hyundai Tucson with only 12k miles on it. That is practically new. It has the SEL Plus option package so it is very nicely equipped. They are asking 27k for it. An actual new one is close to 40k. I have an appointment to see it tomorrow. I am probably going to buy it, but I can't say for certain because I have never even driven a Hyundai.

This Tucson is at the CarMax in my former hometown, Modesto. So my grand plan is to drive SB's little Toyota Corolla to Mom's, take her and my nephew to the CarMax, then if it is a yes my nephew can drive SB's Corolla back to Mom's and we can proceed south to my niece's house.

Posted in

Uncategorized

|

3 Comments »

October 14th, 2022 at 01:02 pm

I had yet another medical procedure yesterday; this time it was a D&C. Without going into too much graphic detail, my menstrual cycle has not been behaving the way you would expect in a 55 year old woman. My primary doctor said she would be content to take a wait and see approach if not for the fact that the cancer I had earlier this year was hormone receptive, and the drug I am now taking (tamoxifin) has as a side effect increased risk of uterine cancer. So off to a specialist I went, who agreed with my primary, and I spent yesterday going under general anesthesia for the procedure, complete with a camera insertion. They did find some polyps and I will get the results of those sometime in the near future.

So the day before the procedure, I had just gotten off work and stopped to pick up some take out. SB was scheduled to work late and I did not feel like cooking. I got back in my car and it wouldn't start. It clearly wasn't the battery as my dash lit up, my AC began to blow, and I had just used the remote key to open the car. No sound from under the hood, not even the initial click. This situation had happened before about 1.5 years previously and I had a new starter installed. I waited a few minutes and tried again, then waited and tried a third time. Still nothing. I had to call a tow truck, get a tow to a nearby repair place, drop the key and instructions in their overnight slot. I called SB while waiting for the tow truck and he said he would leave work early and come to collect me. I should mention here that our home is 22 miles north from the town where I work, and it is up a mountain. Of course the tow truck driver will not drop me home. SB works in a small mountain town a bit further north than ours, so I had to wait a while at the repair place for SB to arrive. I demonstrated for his viewing enjoyment the fact that my car would not start. So it was official. It had been 2 hours of my car not starting.

Yesterday while I was having my procedure, SB went to the repair place to discuss my car. Guess what? It started immediately for them. I actually did not think this was good news. What is going on with my car? I need to be able to rely on it starting. I do a lot of driving through remote areas and I do not want to be stranded.

Today I am just resting at home. Tomorrow I plan to drive down to my mom's house, then take her a couple of hours further south to my niece's house. She and her husband moved into a new house last month, and have recently taken in 3 small children through an adoption agency, with plans to adopt them. They are a sibling group, ages 3 years, 2 years, and 6 months. This niece is also the mother of Mya, the baby for whom I cross-stitched that "Once Upon A Time, A Princess Was Born" project I shared a few years back. Mya is now 3. Mom and I have yet to meet their new children and see their new home.

That is 9 hours of round-trip driving planned for tomorrow. It's not that unusual for me, and I need to be able to rely on my car.

This particular niece and I have been planning a surprise 90th birthday party for my mom this December. This past week I have confirmed that an aunt from Indiana, in her 80s herself, is making the trip out to attend. My mom is going to be so delighted! This aunt is Mom's sister-in-law. She was married for many years to my Dad's youngest brother. Mom has known her since they were both young wives. It's a big deal because there just aren't too many from that generation left. Also a cousin from Vancouver, WA, and a cousin from Spokane, WA and his wife.

And...my kids are both flying out from Illinois! Squee!! While my kids are here, we will be making a trip to the Monterey Bay Aquarium (my daughter's request). We visited often when the kids were growing up and they have that new deep water exhibit that we all want to see. They will only be here for 5 days but we are going to make the most of our time together.

The day before the party, I am going to show up with them at Mom's and tell her happy early birthday present. She will be surprised and delighted, and I think it will throw her off and make her think that nothing else big is afoot. The day of the party, I will insist that we are going out to lunch, then drive her to her party instead. We are having it in the fellowship hall of the church she attends.

So what is the big decision to make, you ask? The car. Do I replace it? It is a 2008 Honda CR-V with 180k miles. I am perfectly content driving it and had hoped to get a much higher number on the odometer. I do not have enough cash on hand to replace it, so buying a different car would mean a loan. I'm not really in to having loans. However, I'm also not into being stranded for hours at a time. And I was lucky to be right in town. I drive through canyons with no cell signal daily. I just don't know.

Posted in

Uncategorized

|

5 Comments »

September 30th, 2022 at 01:55 am

Well, what a crazy couple of weeks it has been. The Mosquito Fire started small, then a few days in there was a very windy day and it grew exponentially. It was about 2.5 miles north of us and 1 mile east of us, with nothing in between but dry timber. The situation changed FAST. Our area was evacuated. I was at work when it happened. SB sent me this picture, taken from our little front yard just as he was leaving:

I thought for sure that our place was going to burn. However, a CalFire crew did a big dozer line just to the east of us, and it held. We got SO lucky.

As it happened, we had been asked to house sit for some friends about 30 miles away. We had declined to stay there for their entire vacation, but agreed to stay there some nights. Well, we ended up staying the whole time. Again, we were so lucky. We did not have to pay for a single night of lodging.

Meanwhile, I started my new job while we were evacuated. It was hard to focus while we were waiting to see what the fire would do. This is my third week and all is going well so far. I am really enjoying it, but it is a big change of focus for me. I work in a beautiful building, with offices centered around a big atrium. It is such a pleasure to enjoy this space. Here is a picture I snapped while sitting at my desk:

Posted in

Uncategorized

|

4 Comments »

August 20th, 2022 at 02:53 am

Well, I got the job. I will start on 9/12/22. I'm very excited. I think it is going to be an opportunity for professional growth. To clarify, I will still be working for my local county, just in a different role in a different department.

Posted in

Uncategorized

|

6 Comments »

June 1st, 2022 at 07:06 pm

An exciting milestone was reached during the month of May. I am now vested in the CalPers pension system. If I stop working right now, at age 62 I am eligible to draw $298.62 per month for the rest of my life. (Because of the Windfall Elimination Provision, receiving the pension will cost me $149.31 of SS benefits monthly once SS payments begin.) If I continue working, the pension amount will increase. If I am successful in moving up to a higher paid position, that will also increase my pension amount. It is obviously not much, still I am very pleased to be vested.

I did get a passing score on the test mentioned in my last entry, and in fact received the highest score in the testing group. Therefore, I have been receiving invites to apply for openings in various departments. However, I have chosen to pass on scheduling those interviews. I have other things on my plate right now and really don't want to take the time to prepare for, dress for, and drive to interviews for jobs I don't want in the first place. I am waiting to be invited to interview for the opening which started this whole process.

I have been off work for a full 6 weeks now, and am still waiting for my first disability check. (In California, we have a state run short-term disability program, which is funded via a direct payroll tax.) There is a website of course, and I can find my account, my claim number, etc. I have received 2 notices, one about my weekly benefit amount ($627) and one informing me that if I also qualify for a program called Paid Family Leave (I don't), then I need to apply for it separately. However, I have not received a notice that my claim has been approved (or disapproved, whatever). According to Google, neither of the 2 notices I have received mean that my claim is approved. Under my claim history, they have posted the first week's payment for the period 4/20-4/26/22. The first week is always unpaid and it does show the benefit amount as $0. But it stops right there, with no information whatsoever about any other time period. I have tried calling, but I get through all of the pre-recorded info, enter my personal info, then am told I will be transferred, then the line just goes dead. This happens at the same exact point each time that I have called. I assume that there are so many callers, they will not even put me in a queue, but of course that is only an assumption. So, I'm really not sure of my status or when to expect some actual money.

Next Tuesday I will begin radiation treatments. I am scheduled for 16 treatments, 1 per day M-F. It is quite a drive to the radiology center and with the cheapest gas available currently costing $5.79 per gallon, I am not looking forward to shelling out for the gas. I really can't complain though, so far my cancer treatment has cost me right at 1k in co-pays. We aren't done yet, of course.

Posted in

Retirement Savings,

Income,

Retire Now

|

9 Comments »

April 21st, 2022 at 03:42 pm

I haven't made a post in almost a year. (In my last post, I had just booked a cruise. Now it is almost time to embark.) For most of that time, I had nothing much to report. Things were just chugging along as planned. Go to work, get paid, save as much of it as possible. As exciting as watching paint dry.

More recently, I have had a health issue to deal with. I was diagnosed with breast cancer. The good news is that it was detected very early and my prognosis is excellent. I have had surgery (lumpectomy and sentinal lymph node removal) and expect to begin radiation at the end of May. It appears I will not need chemo, but no one can say for certain until the test results on my lymph node are in. For the next few months, I will be off work and focusing on recovery.

Recently at work, budget was approved for a new position in a different department which is a good fit for me. The department head approached me and asked if I was interested. It turns out that I am. For her to offer me the job, I must be on the eligibility list. Towards that end, I have submitted an application, been deemed by HR to possess the minimum qualifications, and have taken a written test. If I have a passing score, I will be placed on the eligibility list. If I get this job, it will be a nice bump in pay for me. Currently, I am topped out and earn $57,900 per year. This position tops out at approximately 70k. It would take me 2 years to reach that, but still it would be so good for my bottom line.

Posted in

Uncategorized

|

7 Comments »

June 26th, 2021 at 11:33 pm

This morning, I booked 2 round-trip flights for Mom and me to fly to southern Illinois. Afterwards, I booked an airbnb. Why southern Illinois? My daughter and son-in-law moved there about 1.5 years ago. Last month, my son and daughter-in-law did the same. They are all four living in the same small town. The place I booked is a vacation home on a lake, complete with a hot tub. We should have a really fun week, just hanging out and being together. And playing cards, of course.

It's going to be a fun trip. I am looking forward to seeing my son of course, but I am REALLY looking forward to seeing my daughter. I haven't seen her since we parted in Florida in March 2020. (Whereas I have seen my son several times since then).

I have been setting money aside for this trip and have it covered, even though my current cash balance is a bit lean. This month, I had to pay my 6 month insurance premium ($947.26), put a new starter and brakes in my car ($701.30), bought myself some new clothes ($177.72), plus spent money for birthday gifts and a motel room (see below). So even though I have been saving diligently, I am ending the month with less cash than I started with.

I have a grand-niece and a grand-nephew who are first cousins and were born on the same day. SB and I went to Willits for their birthday parties a few weekends ago; they both turned 9. I paid for the motel room and birthday gifts, as it is my family. It was a very fun weekend. I got to spend some one on one time with two nieces, my brother, my sister-in-law, the birthday girl grand-niece, and my newest grand-niece who was born this past February.

Posted in

Travel

|

1 Comments »

April 14th, 2021 at 03:45 pm

My share of my medical bills ended up being right at $1,400. The vet bill as I mentioned previously was $761.27. I spent $608.62 for my new phone and first month of Verizon's service (prepaid). The deposit for the cruise was $400, of which my mom will reimburse me $200. Also, the registration on my 5th wheel was due and thankfully had come down a bit from last year, $407. (I had saved $481 for it). Then a few miscellaneous things: a new car battery and brake pads, and supplies for a craft project. I put most of these on my credit card of course, but want to pay in full before April ends. The bill is actually due on May 6th.

I have sinking funds for all of these things, but not enough to cover the medical (human and canine) or the phone in full. I had reduced sinking funds to just minimal for the glorious cause of paying off the 5th wheel loan, and was really not wanting to reduce them further. But, it makes no sense to leave money sitting in them when I have expenses I cannot cover from current cash flow. So, I have tapped them yet again but will end April with a credit card balance of $0.00, which is just the way I like it.

Beginning with my first paycheck in May, barring further expenses, I should be able to start rebuilding my savings. The only extra expense on the horizon is the balance of the cruise, which is due in full February 6th.

Posted in

Budgeting,

Spending,

Sinking Funds

|

2 Comments »

April 12th, 2021 at 05:36 pm

Be sure to read the recent comment left on Ima Saver's last blog post here: Text is https://imasaver.savingadvice.com/2016/07/26/i-am-still-here_209394/#comments and Link is https://imasaver.savingadvice.com/2016/07/26/i-am-still-here...

Sadly, Julie has passed away. icantsave thoughtfully left a link to her obituary:

https://www.mountainviewfuneralhome.com/obituary/julia-denski

Posted in

Uncategorized

|

13 Comments »

April 2nd, 2021 at 01:52 am

So nine days ago, our little Bella got hit by a car on our property. Not run over, but hit. (She ignored SB's commands and ran to the car, SB ran after her yelling for the car to stop). The car did stop, but still she collided with it. She had a trip to the 24 hour emergency vet and surgery where they sedated her to give her an xray and scan. She had no internal injuries or broken bones, thank goodness. They dressed her wounds, gave her pain pills, and discharged her. She was very sore the first few days, but has been walking, jumping, etc. as normal for several days now. So that set me back $761.27.

My medical bills for my hospital stay are all in I think, and my share is just a few dollars under 1k. I have been having more tests though, so expect more bills to pay.

My phone has been acting up for a few months. It freezes, it shuts down, in short it has become unreliable. So I am in the market for a new phone sooner rather than later. I am also planning to switch from Ting back to Verizon prepaid. Even though I am on Ting's Verizon service, my calls drop more than they don't. It will be more expensive, but it is not acceptable to be unable to rely on cell service even in town. (I don't even count from home. No matter what, cell service at home will remain unreliable.)

And the most fun money going out, we booked our next cruise. We sail in May 2022. We chose an Alaskan cruisetour, which includes staying in the Princess Lodge in Denali.

SB and I both received our first dose of the Pfizer vaccine today. So far, we both feel fine.

Posted in

Spending,

Travel

|

5 Comments »

March 24th, 2021 at 02:06 pm

It's been fun, 5th wheel loan. Hasta lu bye-bye.

Posted in

5th Wheel Loan

|

8 Comments »

|