|

|

|

|

You are viewing: Main Page

|

|

June 29th, 2024 at 04:46 pm

I've been meaning to give a quick update on all that has happened since relocating.

I absolutely love my new job. I get to do all of the accounts receivable and payable, balance the bank accounts, and now I am working on costing products. It is super fun.

Then about a month ago, both my daughter and my son were both hired for temporary production labor. Right at that time, our HR person left the company. My daughter applied and ended up getting the job. Her office is now right next to mine and we drive to work together every day.

I was invited to go with my daughter-in-law to an ultrasound, so I got to see my grandson on the screen. That was a wonderful experience. My daughter-in-law is now 35 weeks, so not too much longer to wait.

Next week I am going on a trip with one of my oldest friends. We met when we were in the 3rd grade together. A couple of other friends too, there will be 4 of us. We are going to Niagara Falls and to Nova Scotia.

I really like my little house and am happy with my nice quiet neighborhood.

So all in all, I am very glad I made this move. I had to take on a bit of debt and raid my Roth IRA to make it work, and I am certainly earning much less money, but it was the right decision nonetheless.

Posted in

Uncategorized

|

8 Comments »

February 20th, 2024 at 05:13 am

Well, after 5.5 months of being a woman of leisure, today I accepted a job offer. I start the day after tomorrow. This position is a full-charge bookkeeper at a food processing company in a nearby town. I think it is going to be a good fit and I am very excited to roll up my sleeves and get started. 😀

Posted in

Uncategorized

|

5 Comments »

January 26th, 2024 at 06:37 pm

We arrived at our new home on Tuesday; today is Friday. Since arriving, we have been in a whirlwind of activity. We've had roofers come, make repairs, and go. These repairs were quoted months ago. Today we have some plumbers installing a new hot water heater. They will be back on Monday to install a new bathtub and fix a leak.

Before arriving, I had ordered a new queen mattress which was delivered. We have been sleeping on that. We had no other furniture whatsoever upon arrival. Since then, I have purchased a kitchen table and chairs, a dresser, two wing chairs for the living room, and a washer/dryer set which will be delivered next week. We still need quite a bit so more furniture shopping is in my immediate future.

In other news, I have learned that my son and daughter-in-law's expected baby is a boy.

Tomorrow night we are going to a 38 Special concert at a casino in a nearby town.

Posted in

Uncategorized

|

5 Comments »

December 14th, 2023 at 09:43 pm

Yesterday I received the most wonderful news.  My son and daughter-in-law are expecting!! I am over the moon with excitement and happiness. If I had any lingering doubt that I made the right decision to uproot my life and head to Illinois, it is gone now. My son and daughter-in-law are expecting!! I am over the moon with excitement and happiness. If I had any lingering doubt that I made the right decision to uproot my life and head to Illinois, it is gone now.

Posted in

Uncategorized

|

10 Comments »

November 29th, 2023 at 08:59 pm

Yesterday I signed docs, visited a notary to stamp the Deed of Trust, and sent the docs to the title company via UPS. This morning I made a trip to the bank and wired the funds. We will close by the end of the week.

I ended up borrowing 25k, putting down 50k plus closing costs. My monthly payments on the mortgage are $225.00 for two years and then the balance is due. I will owe just under 23k at that time.

Very soon now we will be hitting the road for Illinois.

Posted in

Uncategorized

|

7 Comments »

November 1st, 2023 at 04:44 pm

Well, I am moving forward with the purchase of this latest home. The inspection report did turn up some things, but that is to be expected. The list was not overly long and there are only two items which need to be addressed immediately. Most of the items which need repair I was already aware of, as they are obvious. (Some damage to the siding next to the patio, some trim around a window, etc.) And the house could certainly use some cosmetic improvements. But it is a solid little house, which is exactly what I need.

While I have only seen the house via a video call, my daughter, son-in-law, and son toured it in person. My daughter in particular has a good eye for issues, having worked for a time in construction. Plus, they know what I like. They were unanimous in their opinion that it was the best house they had toured with the realtor.

I will be putting down approximately 45k and taking a mortgage for approximately 35k. The monthly mortgage payments (principal and interest only) will be approximately $314, with the mortgage due in 2 years. I will have the option to extend for an additional 2 years, for a fee.

Here's the listing: 8 Wedgewood Ct, Murphysboro, IL 62966 | realtor.com®

Posted in

Uncategorized

|

8 Comments »

October 20th, 2023 at 09:36 pm

I am currently under contract for a little house in Illinois for the 4th time. This house does not really have any charm, but it was built in 1983. (That's decades newer than the other houses I have been looking at). It seems to be structurally sound. The inspection is scheduled for this coming Monday, so I will know soon enough. This house is a 3/1 with a 1 car attached garage built on a crawlspace (no basement). It has a fenced-in backyard which is a definite plus. It is 960 sq ft and is on a cul-de-sac.

The agreed upon price is 75k. That means I will need to put down approximately 45k and the mortgage will be in the low 30s (closing costs). This will leave me a good chunk of cash to live on until I can find a job.

I really have not been doing a whole lot since recovering from Covid. I have been taking it easy and reading a good bit. I have been getting rid of belongings slowly, but need to increase my pace. If this house works out, I can close by early November and want to move right after. SB is still working full-time, but his boss does know that he is planning to move in the near future.

Do you recall years ago I shared a picture of 3 dogs belonging to a tenant? When we first moved up here, they would bark at me each time I came and went. I decided to befriend them and began giving them treats each time I passed them. (I did clear this with their owner before proceeding). It was not long at all before their angry, territorial barks were replaced with excited barks at the sight of me. They would wiggle with anticipation as I approached their fence. I certainly enjoyed the sweet company of those dogs. Last year, the female australian shepherd got sick and died. Almost immediately, the male yellow lab stopped eating and shortly joined her. This was only a few months before my Bella died. The remaining male black lab just went to his final vet visit on Monday. He was 13 and had declined a lot in the previous few months. One day he could walk, and the next day his legs would not support him. So his owner rightly scheduled his last appointment. I had the opportunity to say good-bye before he went. Their yard is so empty now. I sure do miss all 3 of them. It makes me want to move all the more.

Here is the entry which contains a picture of them: Let It Snow: Reaching For Financial Security (savingadvice.com)

Posted in

Uncategorized

|

2 Comments »

September 26th, 2023 at 03:19 am

I must have been exposed to Covid on my flight home. I have been so sick for more than a week. I still feel very crummy, but somewhat less crummy. Therefore, I am cautiously optimistic that the worst is behind me.

I am under contract for a house, we are currently negotiating over the items in the inspection report, so the purchase is still up in the air.

Posted in

Uncategorized

|

6 Comments »

September 12th, 2023 at 04:20 pm

I am in Illinois now. Last night, I spent the night at my son's house.

I am not buying that little blue craftsman; it has foundation issues.

I have been seeing houses but haven't found one yet which will work.

I don't think I am going to find a house which I can currently pay cash for which will suit my needs. While a traditional mortgage is currently not an option, a hard money loan is.

You may recall that SB has previously lent money through an investor group for a hard money loan. The same group is willing to lend to me. I can borrow at 7%, with a 2% funding fee, for 2 years. At the end of 2 years, if I wish, I can roll it over for 2 more years with another 2% funding fee. This would allow me to buy a more expensive home right now, without a job.

I am going to explore this idea a bit more and see some more homes.

Posted in

Uncategorized

|

4 Comments »

September 4th, 2023 at 11:03 pm

The seller must have come home early, because my realtor called and my offer has been accepted! I am under contract for this little house:

Text is https://www.realtor.com/realestateandhomes-detail/437-North-St_Murphysboro_IL_62966_M89223-45366 and Link is https://www.realtor.com/realestateandhomes-detail/437-North-...

My realtor is scheduling inspections. A major problem will be cause to re-negotiate or cancel. Minor repairs are to be expected and will not scare me off.

What do you think? I like it so much.

Posted in

Uncategorized

|

10 Comments »

September 2nd, 2023 at 08:41 pm

Yesterday was my last day working for El Dorado County. I'm not certain that it has sunk all the way in yet.

Since my last entry, I found another cute little ranch and made an offer. It was listed at 50k; Zillow estimated its value at 47k. My realtor told me that they were expecting multiple offers and I should make my very best offer if I wanted it. Well, I was somewhat skeptical. Was that just a ploy to get me to offer more? Besides, they can "expect" anything they please, that doesn't mean it will happen. I know that Zillow is not always accurate, but I was reluctant to offer much over Zillow's estimate. I offered 52k and my offer was not selected. I have been waiting for escrow to close so I can look up the sales price. Yesterday I saw that it had sold for 66k. So it had not been a ploy at all. I trust my realtor more now.

I found a little craftsman bungalow for sale. It is super cute. It has a lot of nice features. It is in fairly good condition (not perfect), but it has had some very tasteful updates. It has a new kitchen and a new bath, plus a newish roof and furnace. The list price is 55k. I made an offer for 55k, my realtor sent it off, and then she told me the listing agent says she has one other offer already. The seller is out of town until Tuesday, will review offers then, so I should make my best offer. I listened to her more closely this time. I asked her what she thinks the house is worth. She pulled comps and sent me her analysis; she thinks it is worth 68k. I thought about it, checked today's listings to see what else is listed in that price range, and decided to offer 68k. This is the pinnacle of what I feel I can pay without a mortgage. So the seller will take my offer or he won't; I'm not going to offer any higher.

One week from today I fly to St Louis. My daughter and son-in-law will pick me up there and I will spend a week visiting them and my son and daughter-in-law, plus her grandma. While I am there, I will either see the craftsman (because I am under contract for it) or a bunch of other houses (because I am still looking).

Posted in

Uncategorized

|

4 Comments »

July 30th, 2023 at 07:10 pm

So one thing I have been thinking of A LOT lately is how much I have in available funds. I currently have 18k in savings and 41.6k available in my Roth. I anticipate netting 22k or so from selling the truck, which will be a quick sale. Also I hope at least 20k from selling the 5th wheel, but that may take longer to accomplish. More on that below. And then of course as soon as I am separated from my employer, I will have access to the 25k in my 457 plan, although I hope to not touch that this year. So that is 18k +41.6k + 22k = 81.6k which I can count on having available immediately, plus another 45k which will be on the horizon. I'm not going to lie, I wish that I had more. I am trying to buy a house plus live on this money until I find a new job.

I have been mulling over the idea of taking a personal loan someplace, to cushion my bank account. Of course, this is something which will cost me money. I'm not really certain I want another loan, but once I am no longer employed it will no longer be an option. If it turns out that I need a loan, it will be too late. Of course, I can always use my credit cards to pay for necessities. But this is not an appealing idea if I lack the funds to pay for my charges; a loan would likely be less expensive. So I have looked online a bit and the best deal I could find was with Citibank. On Friday, I accepted their loan; my check is in the mail. The terms are no origination fees, 11.99% interest, a 5 year repayment schedule, no prepayment penalty. When I receive the funds, I will throw them in savings and that will reduce the cost. Once I have a job, paying off this loan will be a high priority.

I have my eye on 2 houses listed for sale, both at 59k. The one which I like the most has recently been completely re-done inside. It is small, only 800 sq ft, but it is on 1/3 of an acre, unfenced. The other is a bit larger at 892 sq ft, but sits very close to the neighbors on both sides. It has a covered front porch which I just love and a fully fenced backyard. If they are still listed when I go to Illinois in September, I will see them. And I will keep updating my list between now and then.

I have some friends in my old area who camp a lot. The husband is very knowledgable about vehicles in general, including travel trailers and 5th wheels. If necessary, he will keep my 5th wheel and handle the sale, for a commission. I offered the commission, he did not ask. It will be a chore, so I wouldn't feel right about not compensating him for his time and trouble. I trust these friends completely and have no fear that he would cheat me in some way. Of course, I would prefer to sell the 5th wheel myself and quickly, but in case it does not work out that way, I do not want the 5th wheel holding me up from heading to Illinois.

Posted in

Uncategorized

|

4 Comments »

July 26th, 2023 at 05:19 pm

The home inspection showed a lot of issues. I expected that there would be some, so it was not surprising to see the long list. Some of them were no big deal, but a couple of them were deal-breakers. For example, there is an old water leak in the bathroom. Water is going into the subfloor and has been for some time, but no repairs have been made. Water is going into the wall around one of the AC units because there is no barrier, even though there should be. There is standing water in the crawlspace under the house. There are water stains on the foundation. There are also some foundation issues.

I am still moving, just not into that particular house. It's disappointing, but that's how it goes sometimes.

Posted in

Uncategorized

|

8 Comments »

July 18th, 2023 at 03:32 am

I submitted my resignation today. My last day of employment will be Friday, Sept 1.

Posted in

Uncategorized

|

3 Comments »

July 16th, 2023 at 02:08 pm

Well, I certainly have a long "to do" list. And my finances are about to become topsy-turvy with no income but plenty of outgo. I will need to think about budgeting my money in a very different way.

So far, I have paid a $500 earnest money deposit, plus a processing fee of $12. I had to pay via DepositLink and there was no way to avoid the fee. That came directly from my checking account. I also paid $460 to the home inspection company along with an $18.17 processing fee because I used my credit card.

Around here, we have already begun parting with possessions. There is still plenty more to do on that front. The 5th wheel needs a few repairs which we have been putting off because repair work is a bit problematic. However, it goes in to the shop on August 9th. The repairs are expected to take a few weeks. We will have to move into the little travel trailer for that time. It needs a new door first. And, the bears completely ruined the fridge. The door will not latch closed and all of the interior shelves and brackets were ripped out. So we will have a place to sleep and a roof over our heads, but not much else. It will just be for a short time, though.

This past Friday I took a half day vacation and went down to the valley. A girlfriend who is 42 and expecting her first baby was having a baby shower. It was wonderful to see her and her mother and sister, niece and nephew. There were other guests but I did not know a one of them! Still, I had a very nice time. They were all lovely. It was a great opportunity to see her in person and let her know that I am moving even further away. After the shower, I went to my mom's house and spent the night. We played cards in the morning and I left around noon to return home.

Posted in

Uncategorized

|

1 Comments »

July 15th, 2023 at 01:07 pm

My offer has been accepted. This is real and moving fast. 😀

Posted in

Uncategorized

|

4 Comments »

July 13th, 2023 at 06:06 pm

I have made a really huge decision. I can't believe that I am doing this, but I am.

My boss is on vacation this week, so next week I will tell her that my last day will be Friday, Sept. 1. I am wrapping up my life here and moving to Carbondale.

There is still much up in the air, but each kerfuffle will be dealt with as it arises. Just like life, right?

I will have my health insurance through the end of September. I can buy a silver plan on Covered California for $165.29 per month, which I will do until I am settled in Illinois.

I will sell the 5th wheel, SB and I will sell the truck, SB will sell his Toyota Corolla. We will move in my Hyundai Tucson.

I had previously shared a link to a little white house with orangey-brown trim. Well, it is back on the market. My son has a scheduled showing this coming Tuesday and will video it for me. Google Earth shows it is in a nieghborhood of houses and big trees, a few parks, no businesses. And it is only a few blocks from the university campus. It is 1.3 miles from my son's house, 5.8 miles from my daughter's house. I am fairly certain I am going to buy it.

I do not qualify for a mortgage. Purchasing this home will take all of my Roth IRA contributions plus most of my current savings. This is not ideal, but it is the situation. I will of course have the proceeds from selling the 5th wheel and truck, and once separated I can access the 24k in my 457 plan, taxable but no penalty. That is what I will have to live on until I am settled and have found a new job.

Oh, and I will still have my car loan. I had wanted to pay it in full before moving, but paying 50K + closing costs for a house makes that not possible. I won't have a mortgage payment though, so there is that.

I am still going to take my "vacation" to Illinois Sept 9-16. The airfare I bought was nonrefundable. We could cancel the airbnb, but I really don't want to. Besides, this will be a good opportunity to get the house set up a bit.

If purchasing this particular home does not work out, I am moving anyway. All of my plans will stay the same except I will need to find a rental with cash in hand but no job.

So, that is my news.

UPDATE: I have submitted my offer of 50k cash contingent on inspections, requested the seller to pay for a 1 year home warranty, requested 21 days to do inspections, requested a closing date of 8/31. The tenants have until 7/31 to vacate, so I cannot do any inspections until then.

Posted in

Uncategorized

|

5 Comments »

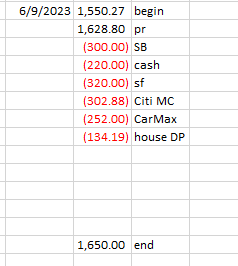

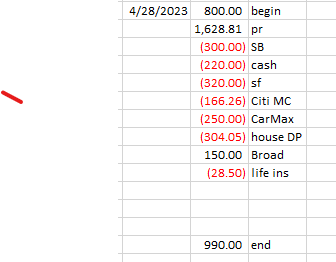

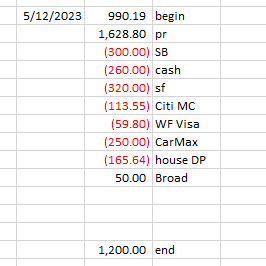

July 11th, 2023 at 04:34 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

sf - automatic sinking funds transfers scheduled for 7/11/23

cash - cash for the next 2 weeks

Citi MC - the balance this time includes a tank of gas and some eating out

CarMax - a payment towards my car loan. The new balance is $21,008.23

house DP - a contribution towards my house down payment. The new balance is $2,002.92.

end - ending checking account balance

Posted in

Budget By Paycheck

|

0 Comments »

July 6th, 2023 at 03:22 pm

My daughter sent me a link to a house. It is SO cute. It needs some work, but mostly cosmetic as far as I can tell. It has good bones. In addition to the pictures on realtor.com, my daughter sent me pics from Google Earth, and my son went to the house and sent me a bunch of exterior pics. It is a foreclosure, and it is listed at 24.9k. It has been on realtor.com for a month already. I have spoken with the listing agent and late last night sent him a text that I would like to move forward with a home inspection.

The house is not in the same town where my kids live, but it is not too far either. It is 11 miles from my daughter's house and 16 miles from my son's.

So depending on what the home inspection shows, I may be moving MUCH sooner than planned. I am both terrified and SO EXCITED.

So before this popped up, last week I booked myself airfare to see my kids in September. My daughter and her husband have been in Mississippi for about 6 months now and will return home just before I come to visit. It is a long story and it isn't mine, but it has to do with his mother and a house he inherited. It has taken quite some time to get it all sorted, but things there will be wrapping up for them. My son and his wife had offered that I could stay in their spare bedroom during my visit. However, my daughter was planning on staying in a hotel the first few days they were back (so they can fumigate before moving back in) and suggested that we rent an airbnb. We found a nice one at a good price and she and I split the cost. I will still spend 2 or 3 nights at my son's house.

UPDATE: The house is under contract this morning, and not with me.

Posted in

Uncategorized

|

7 Comments »

June 27th, 2023 at 02:48 pm

I'm not sure if I have mentioned this before but I have a good bit of extended family in this area. One of my mother's sisters and her husband raised their family in the next little town over. They had 4 daughters, 3 of whom have spent their lives and raised their families here. Unfortunately, there is a great deal of substance abuse in the lives of many of these relatives. I am fond of them and friendly with them, but I am not close with them and do not spend any significant time with them.

Well, about 2 weeks ago SB spotted a flyer which had been posted around town. A 40 year old woman was missing. She is the daughter of one of my first cousins. She was last seen on 6/7/23. Well, since then her body has been found. It is very sad. No word yet on if her death was accidental or if foul play was involved. There is a Go Fund Me to cover her final expenses. I sent $100, so I'm going to transfer it back to myself out of my Gifts sinking fund.

Posted in

Sinking Funds

|

3 Comments »

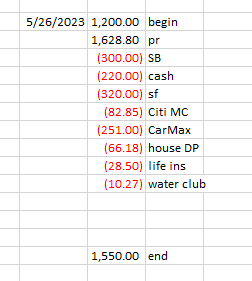

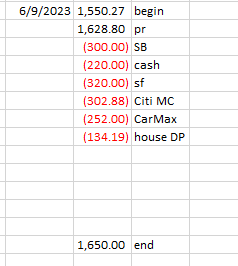

June 25th, 2023 at 04:52 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - cash for the next 2 weeks

sf - automatic transfers to sinking funds scheduled for 6/27/23

Citi MC - this payment includes my Verizon bill, my Netflix bill, my Sirius XM bill, a co-pay for prescription refills at $58.32, a donation of $55.84 (details below), and $12.58 for a fast food lunch out.

CarMax - my car payment. the new balance is $21,221.94

house DP - a contribution to my house down payment fund. the new balance is $1,696.05

life ins - my monthly life insurance premium.

water club - my tab for the water club at work

end - ending checking account balance. I have $750 set aside for dental expenses which are estimated to be approximately 1k.

Donation - I have a niece who is really in to cat rescue. This niece is my ex-husband's sister's daughter. Currently, she and her long-term boyfriend are saving up to move (the house they rent is being sold) and she is having trouble affording cat supplies. She has a wish list on Amazon; I bought her some cat food.

Posted in

Budget By Paycheck

|

2 Comments »

June 19th, 2023 at 05:00 pm

Today I transferred the following out of sinking funds:

Ins & Reg $1,086.76 - 6 month insurance premium for 5th wheel and Tucson

R & M $74.41 - oil change for Tucson

eGadgets $29.85 - new laptop charger

These charges are all on my Citi MC and the time has come to cough up the money. When these funds hit checking, I will send them off to Citi.

Posted in

Sinking Funds

|

0 Comments »

June 10th, 2023 at 04:18 pm

Begin - beginning checking account balance ($0.27 interest paid on 5/31/23)

pr - net payroll check

SB - my contribution towards our joint living expenses

cash - cash for the next 2 weeks

sf - automatic sinking funds transfers scheduled for 6/13/23

Citi MC - the balance this time includes a $250 payment to the endodontist and $52.88 for gas (I had Gilligan with me and wanted to pay at the pump)

CarMax - a payment towards my car loan. The new balance is $21,434.24.

House DP - a contribution to my house down payment fund. The new balance is $1,537.31.

end - my ending checking account balance. And that is it, my paycheck is spent.

I have $650 saved for my dental expenses, and have already paid $250. I need approximately another $350. When I went to the endodontist, he discovered that I had a fistula. He did the root canal and treated the fistula. I have to wait 5 weeks then go back so he can check if the fistula has healed before he is done with me. Maybe the costs will rise because I will have another office visit. They didn't say and I didn't ask, but it won't surprise me.

Posted in

Budget By Paycheck

|

3 Comments »

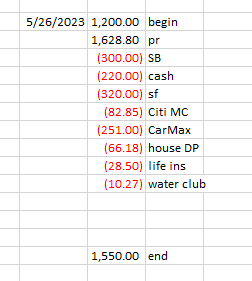

May 26th, 2023 at 11:59 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution to our joint living expenses

cash - cash until next payday

SF - automatic transfers to sinking funds scheduled for 5/30/23

Citi MC - the balance this time covered 3 bills: Verizon, Netflix, and Sirius XM.

CarMax - a payment towards my car loan. I thought it would be fun to add another dollar every time, so that's what I did. The new balance is $21,645.14.

house DP - a contribution to my house down payment fund. The new balance is $1,398.71.

life ins - monthly life insurance premium

water club - my tab for the water club at work

end - ending checking account balance. I now have $550 set aside for my pending dental bills.

And that is it, today's paycheck is spent.

Posted in

Budget By Paycheck

|

0 Comments »

May 23rd, 2023 at 11:04 pm

I had my first dental appointment for my crown this morning. The dentist said he was drilling deep and that when the novacaine wore off my jaw was going to be sore. He was sure right about that. (I went home afterwards and took a nap).

After he drilled, they did another xray. He said that he feels for best results, the tooth needs a root canal. Ugh! He referred me to an endodonist for that. My share of cost will be approximately $550, in addition to the $700 for the crown.

UPDATE: I ended up taking both Tuesday and Wednesday off from work, sick. I slept a lot, whimpering periodically.

Posted in

Spending

|

2 Comments »

May 20th, 2023 at 05:02 pm

Today I transferred $313 out of my ins/reg fund to pay the 5th wheel registration. I also transferred $406.65 from my Gilligan fund to pay for the vet bill to have him neutered. I also sent proof of neuter off to the shelter last week, and returned my signed adoption contract via email yesterday. Gilligan is officially my dog.

I just hate it when my savings balance goes down instead of up, but of course the money had been set aside for those particular expenses.

Posted in

Spending,

Sinking Funds

|

2 Comments »

May 18th, 2023 at 10:51 pm

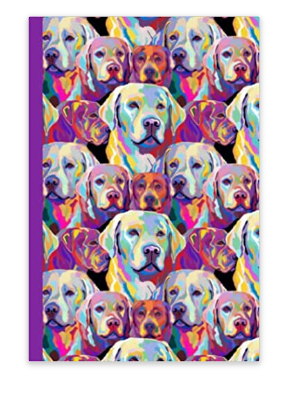

My SnugglyBumps has been working on a project. He decided that he wanted to open an online store. He designed a cover, put it on a hardback notebook with good quality paper, and his link has gone live on Amazon.

He has some additional products in the pipeline which are not ready for sale just yet.

Here is his cover, a tribute to our sweet Nala Jean:

Please note: I am just sharing. This is not an attempt to sell a product. I am rather impressed with his creativity.

Posted in

Uncategorized

|

3 Comments »

May 12th, 2023 at 11:07 pm

So as you know, I have decided I want to retire to the place both of my kids are now living. Exactly when has been up in the air. Lately, I have been thinking that at 56.25, I am not so very far away from 59.5, that magic age where carefully following 72t rules will no longer be required. So, why not try to plan my retirement date around that? Can I make it work? I have been crunching numbers, and I think that I can.

If I work from now until age 59.5, I calculate that my monthly CalPers pension will be $946 per month. Of course, it won't begin until I have reached 62, so that is 2.5 years of living on savings only.

I have a spreadsheet (I have shared it before) that calculates my tax-deferred balance as I begin taking withdrawals. My goal is to still have money at age 100. Of course, I have to assume some rate of return, which may prove to be inaccurate. I use 5%, which I think is very reasonable. But still, as there is no guarantee, I like to build in some buffer. For example, I have built in a 3% annual COLA. If we hit some years of very bad market returns, I can reduce it or forego it completely for a year or two, which certainly helps prolong the life of my portfolio. When I calculate, I use the "rounddown" function, which also builds in some buffer. So if I begin at age 59.5 with a 2k per month withdrawal, increase it at 3% annually, decrease it at age 62 by the amount of my pension (which also has an annual COLA), and project out to age 100, I still have 274k at the end. I feel pretty safe with that. I am not calculating in any SS benefits, even though I do expect to receive a small amount. I intend to enroll when I reach age 65, so that I can have my Medicare premium deducted from it.

So 2k per month is not a fortune to live on, but I feel I can make it work. And, work well enough to lead a very happy life in the same area where my kids are. I have some time yet to investigate various costs and play around with that 2k per month budget.

One thing that would absolutely need to happen is my car loan would need to be paid in full by age 59.5. So, I have played around with those numbers. If I continue paying $250 per paycheck for now, then bump it up to $268 per paycheck after I receive my Step raise in September, then bump it up to $296 per paycheck after I receive my Step raise in September 2024, I will pay the loan in full on 7/30/26, exactly 2 weeks before I turn 59.5. That is a very doable plan and does not represent a hardship of any kind. So that piece of the plan is ironed out.

Now there is the small matter of a house. I want to be realistic about how much I can save. Things always seem to come up, like needing a crown. However, if I take the balance I have right now and add $225 to it each and every paycheck between now and the end of July 2026, I will have over 21k. I think that I can average more than $225 per paycheck. In fact, I think I can easily break 30k . However, I do not think I can have 50k saved up in only 3.25 years. Frankly, I am not too sure that you can buy a 50k house and take a 20k mortgage. Maybe you can? I would think that a lender wouldn't want to bother. Or maybe a HELOC for the 20k would be an option. Or, I could pull 20k out of my Roth. My Roth isn't huge, so I don't really like that idea. And what if the ideal house ends up being 65k? For sure I would want to look at borrowing some of that; 35k would be too much to pull from my Roth.

So it may be that if I am looking at having to carry a small mortgage, I will decide that 2k is simply not enough and I need to work a bit longer, save a bit more money, and let my pension increase a little bit more. If that is how it goes, then I will have to adjust. However, I am going to aim for 59.5 and see if I can hit it.

Posted in

Retirement Dreams

|

4 Comments »

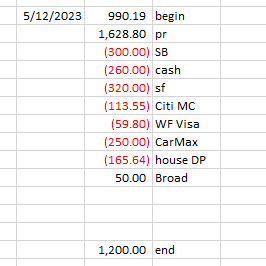

May 12th, 2023 at 09:58 pm

begin - my beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - cash for gas, personal, and misc

sf - automatic transfers to sinking funds scheduled for 5/16/23

Citi MC - the balance this time included $52.68 for gas, $33.33 for Papa Murphy's, and $27.54 for groceries at Safeway. We house sat last week, plus Birth Mom was here for a visit. We spent more than usual for groceries and take out.

WF Visa - the balance included $51.35 for Gilligan's flea meds and $8.45 for a set of 4 drinking glasses at Wal-Mart.

CarMax - my car payment. The new balance is $21,854.65.

house DP - contribution to my house down payment fund. The new balance is $1,332.53.

Broad - the last $50 owed, expected next Friday 5/19/23

end - my ending checking account balance.

I realized that I have longer to save for my crown than I had thought at first. It will take 2 appointments to complete the crown, then they will bill my insurance, then finally after the insurance pays they will bill me. I will use my Citi MC to pay the dentist then have at least 1 paycheck, possibly 2, before the statement due date. I have not even had the first appointment yet. $200 is enough to set aside from today's paycheck.

And that's it, today's paycheck has been spent.

Posted in

Budget By Paycheck

|

1 Comments »

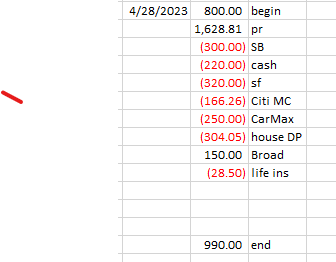

April 29th, 2023 at 02:52 pm

begin - beginning checking account balance

pr - my net payroll check

SB - my contribution towards our joint living expenses

cash - My budgeted amount is $260, but I only needed $220. I forgot to adjust before I made my House DP transfer, so I ended up with an extra $40 in checking. I just left it there, because I will have a big expense to pay beginning with the next paycheck. More on that below.

sf - automatic sinking funds transfer which will happen on 5/2/23.

Citi MC - the balance on my Citi MC. It included $149.35 for a meal out, and $16.91 for Sirius XM. The meal out was dinner and drinks for 3. I have a couple of girlfriends from work, we all now work in different departments in different buildings. We meet up every month or two at a particular restaurant. We take turns paying, and it was my turn. The restaurant has gotten a bit pricey, as you can see. The Sirius XM is a new expense. When I bought the Tucson, 3 months were included free. Then I received an email offering me an additional 3 months for $2. I accepted that. And I have found that I really enjoy it. My promotional subscription ended on 4/14/23, I downgraded the membership from premium to music only and kept it.

CarMax - I rounded the half-payment up to $250 as that is the amount I was saving towards my next car out of each paycheck before purchasing the Tucson. The new balance is $22,062.52. Edited to Add: On 5/5/23, while clearing my checking account transactions, I noticed that this payment had not hit my bank account. I logged on to CarMax, and there is no record of this payment. So annoying! I scheduled it again for today, and of course there is now more interest due. I just hate debt. The new balance is higher than it should be, at $22,086.68.

house DP - the amount I had available to contribute. The new balance in the fund is $1,161.51.

Broad - a loan repayment. The loan balance is down to $50 now.

life ins - my monthly life insurance premium.

end - the ending balance in my checking account.

So I went to the dentist on Monday for my bi-annual cleaning and it was time for x-rays. Bad news, I need a crown. My share of cost for that is $610, plus I will owe something for Monday. I will pay the dentist with my Citi MC, and then will have 2 paychecks to get the balance paid in full. Of course, this will impact my savings efforts which is frustrating, but it is what it is.

Posted in

Budget By Paycheck

|

1 Comments »

|